Credit Card Interchange – VISA MC Settlement

Credit Card Interchange Post VISA/MC Agreement

We all heard about the settlement with VISA and Mastercard and how consumers would see benefit. Unfortunately that is only a headline, not a fact. Once again Jordan with Reforming Retail breaks the settlement down, and what we find is same old same old (increasing rates). I like his cookies analogy where there are three ingredients: eggs, flour and sugar. After much discussion the cookie manufacturers agree to lower the cost of eggs. But guess what — the flour and sugar are going up.

Get a subscription to Reforming Retail to stay in the know is our advice.

Here’s a Pilot summary of the key points:

- 20-Year Litigation: discusses a lengthy legal battle involving Visa and Mastercard, accused of operating a duopoly and imposing excessive fees

- Settlement Outcome: It highlights that the settlement benefits lawyers more than merchants, with no significant changes for small businesses.

- Swipe Fees Data: The article provides data showing a record $160 billion in swipe fees paid by U.S. merchants in 2022, a 16.7% increase from 2021

- Fundamental Change Needed: The text argues that without a fundamental restructuring of the payment system, merchants will continue to face unfair fees

The article is critical of the current payment system and suggests that real change is necessary for merchants to benefit.

Here’s your Chat GPT summary of the Visa, Mastercard settlement:

- After 20 years of litigation there’s no practical change and merchants will continue to get screwed

- The lawyers are the real winners, reaping billions of dollars despite a useless outcome

- Visa and Mastercard will continue making unlimited money via non-Interchange fees (i.e. dues and assessments)

- Small merchants on flat-rate pricing will see any potential benefit accrue to their processors

- Zero practical changes to surcharging despite the lip service

The Visa, Mastercard Settlement Is A Massive Joke And A Waste of Everyone’s Time

The winners?

The lawyers.

In fact, in reading the outcome of the settlement we’re convinced that the plaintiffs’ lawyers knew that their clients weren’t actually going to receive any benefit.

That’s right merchants: after this settlement you can… keep bending over and taking even more from the payments ecosystem.

In no way, shape, or form do merchants win, particularly the “small business” variety for which Visa and Mastercard so arduously fight to protect from… themselves? We never understood their positioning, frankly.

And nor will merchants ever win without a fundamental restructuring of payments as we know it.

FACT: Per Nilson Report, in 2022, U.S. merchants paid a record $160 billion in swipe fees. This represents a 16.7% increase in fees from 2021.

FACT: Despite the pandemic and inflationary pressures, swipe fees continue to rise. The average rate of YoY costs rose from 7% between 2013 and 2020, to 21% afterwards. Initial estimates suggest card fee hikes could cost U.S. retailers over $500 million

FACT: American merchants—retailers, restaurants, contractors and anyone that accept credit cards—pay five times more in swipe fees for the exact same transaction than VISA and Mastercard charge businesses in other countries.

Note that this growth in fees generally tracks the growth in US credit card volume:

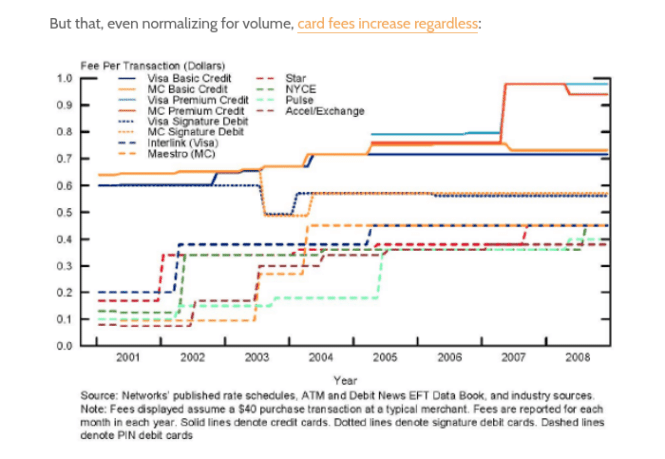

But that, even normalizing for volume, card fees increase regardless:

That’s because Visa and Mastercard (and to lesser extent Amex) are utilities, protected by banking and finance laws that ensure that utilities continue to reap tens of billions a year in what is tantamount to EBITDA (the card schemes have no real costs and one only need examine Pix to quantify the expense of both building and maintaining a real-time payment network supporting trillions of dollars in volume; hint, it’s a few million dollars).

Let’s break our discussion/analysis into three buckets.

Interchange “Cap” Does Not Equal Lower Processing Costs

Talk about a con job.

What great collusion from the attorneys on this one.

Plaintiff Attorneys: Okay, so our law firm can’t make billions without something to show for it. What can you offer us?

Defendant Attorneys: Hmm… what if we agree that our clients will lower “Interchange”?

Plaintiff Attorneys: Wait: won’t that affect your client’s revenues? I own a lot of their stock since they’re duopolies with infinite pricing power and I need that to pay from my wife’s 9th rhinoplasty.

Defendant Attorneys: LOLz. Bro, do you even litigate? “Interchange” caps mean nothing! Our clients have dues, assessments, and other fees that they can add to their hearts’ desire to ensure that they keep crushing the quarter so your wife won’t look a day over 77.

Plaintiff Attorneys: Thank you, Jesus!

Defendant Attorneys: Just remember who did you a solid when your firm takes your $2B payday.

Plaintiff Attorneys: Oh, don’t you worry: I’ll definitely be calling my wife’s plastic surgeon to tell him that your wife’s next boob job is on me.

Defendant Attorneys: Perfect. See at our 8 AM tee time tomorrow.

Let’s see if we can’t put this into an easier analogy to follow.

Imagine that you belong to a race of people that must eat cookies to survive.

Cookies have three ingredients: eggs, flour, and sugar.

There are only two cookie manufacturers, and they are very aware that your entice race of people will die without cookies.

And they keep increasing the price of cookies.

Well, some of you cookie-eaters band together and sue the cookie manufacturers.

After much hemming and hawing, the two cookie manufacturers agree to lower the price of eggs.

Your lawyers pat themselves on the back.

But you’re no fool.

You know that there are two other ingredients in the cookies.

Without a guarantee that the flour and sugar will also come down in cost, the cookies might be more expensive.

Not only might, but with near certainty will be more expensive given the history of the cookie manufacturers.

WTF?

Note: we are not anti-capitalists by any stretch of the imagination. Indeed, we are about as pro free-market as one can get. But Visa and Mastercard do NOT operate in a free market, and that is the delusion here.

Visa and Mastercard are free to change non-Interchange fees as they see fit, and we guarantee that they will.

Watch.

There will be no missing earnings despite the optics this settlement might have you believe.

SMB Merchants Get Hosed

Let us tell you a story from 9 years ago.

In a far away land called Europa, the governing bodies looked at the costs of payment acceptance and viewed them as a tax on their constituents (never mind that Europa had a seemingly endless number of other taxes that drove many businesses to establish operations elsewhere).

In 2015 these governing bodies passed a law called PSD2 that included provisions to lower the cost of payments acceptance.

How?

By reducing the cost of interchange, or the amount that the card issuing banks and card schemes take from each card transaction.

But the people working in those governing bodies had never actually had a real job, or they would know better.

Just because one decrees something doesn’t make it so.

The governing bodies had clearly forgotten about mercedem fratibus, colloquially known as merchant acquirers, or to all our readers, payment bros.

This particular group of individuals believe it their God-given responsibility to ensure that merchants receive no such savings from any decree, and that instead those savings end up in their own pockets.

And that’s precisely what transpired.

A European Commission study in 2020 found that the interchange caps redistributed revenues from interchange: merchants saved $1.2B Euros annually, and then merchant acquirers gained $1.2B Euros annually.

The merchants who recognized the savings?

Large, tier 1 merchants that hired their own payment bro consultants.

Back to the US settlement…

Under the agreed-upon guidelines, Visa and Mastercard would reduce swipe rates by at least four basis points (0.04 percentage points) for three years and ensure an average rate that is seven basis points below the current average for five years.

These savings will not reach SMB merchants because their processors are nearly exclusively flat-rate their processing pricing. So instead of their merchants seeing the benefit on an interchange plus pricing model, their merchants are paying a flat, fixed percentage on each transaction, with savings accreting to the processor.

Just like in that magical land of Europa, these processors will see a 7 bps increase in EBITDA.

Not revenue: EBITDA.

As far as this blog’s coverage is concerned, here’s who stands to benefit:

- Toast

- Square

- Shopify

- Lightspeed

The math for these guys will be quite compelling. Toast for example, does $126B of GPV. 7 bps on this is $88M.

Of free money.

The Surcharging Changes Do Nothing

There’s a lot of indigestion over surcharging.

Smart consumers hate it. The average consumer who thinks that they’re earning 1% cash back by paying via card is actually losing 3% to pay via card as processors convince more merchants to surcharge.

The card schemes hate it because the above math should, at some point, lead consumers to use alternative payment methods (but Americans are nearly as financially illiterate as merchants).

Payment bros love it. What easier way to make free money than to surcharge?

But those asshole card schemes are capping my surcharge income by decreasing the surcharge limits to 3%. It should be a much more reasonable cap of 3,000,000%. That feels fair for the value I provide.

No shortage of animosity.

And confusion.

That’s because if you actually read the surcharging language in the merchant rules for Visa, Mastercard, and Amex, you’ll find discordance that makes it impermissible to surcharge.

Since this settlement pertains to Visa and Mastercard we need to read the Amex rules:

3.2. Treatment of the American Express Brand

Merchants must not… impose any restrictions, conditions, disadvantages, or fees when the Card is accepted that are not imposed equally on all Other Payment Products, except for electronic funds transfer, or cash and check,

https://www.americanexpress.com/content/dam/amex/us/merchant/new-merchant-regulations/Reference-Guide_EN_US.pdf

FIS does a great job producing collateral that explains the discordance:

Amex has a non-discrimination policy, but their regulations require imposing equal treatment across all Other Payment products. A payment product is defined as any charge, credit, debit, stored value, prepaid, smart card, account access devices or other payment cards, services or products other than the Card. Since the Amex requirement includes debit and prepaid products and it is against Visa and Mastercard rules to surcharge debit and prepaid products, merchants wishing to charge a surcharge would be considered non-compliant (from an Amex rules perspective) in certain scenarios.

https://empower2.fisglobal.com/rs/092-EMI-875/images/Merchant%20Surcharging%20Guide%20External%2001132023.pdf

Embedding below for convenient reading.

None of the merchant rules make sense because none of the card schemes actually want merchants to surcharge.

In comes this VIsa, Mastercard settlement to confuse surcharging even more… but it’s for absolutely nothing.

Motion for the sake of motion with nothing substantive accomplished.

At least the proposed surcharging language is consistent with the rest of the settlement and is, in itself, a huge joke and waste of everyone’s time.

Borrowing from TSG’s analysis, here are the four main points as the settlement pertains to surcharging:

- Brand Level Surcharge Rules on Credit (not Debit) Cards: A brand-level surcharge is one in which the merchant imposes the same surcharge on all of a particular network’s (e.g., Visa’s) credit cards regardless of the issuing bank (e.g., Chase) or the product (e.g., Visa Signature card). Under the Settlement Agreement, a merchant can surcharge all Visa-Branded Credit Cards up to 1% regardless of whether the merchant also surcharges other comparator credit cards that it accepts, e.g., American Express or Discover. Under the Settlement Agreement, a merchant can surcharge all Visa-Branded Credit Cards up to 3% (or the merchant’s cost of acceptance if it is less than 3%), if the merchant either (a) does not accept other comparator credit cards (e.g., American Express or Discover) or (b) does accept those comparator credit cards but also surcharges them in at least the same amount. The same rules apply to surcharging Mastercard-Branded Credit Cards at the brand level.

- Product Level Surcharge Rules on Credit (not Debit) Cards: A product-level surcharge is one in which the merchant imposes the same surcharge on all of the network’s (e.g., Visa’s) credit cards of a specific product type, e.g., Visa Signature credit cards, regardless of the issuing bank (e.g., Chase). Under the Settlement Agreement, a merchant can surcharge a particular Visa-Branded Credit Card product up to 1% regardless of whether the merchant also surcharges the comparable products of other comparator credit cards that it accepts (e.g., American Expressor Discover). Under the Settlement Agreement, a merchant can surcharge a particular Visa-Branded Credit Card product up to 3% (or the merchant’s cost of acceptance if it is less than 3%), if the merchant either (a) does not accept other comparator credit cards (e.g., American Express or Discover) or (b) does accept those comparator credit cards but also surcharges their comparable products in at least the same amount. If the merchant cannot readily determine its cost of acceptance of the Visa product at the point-of-sale, before authorization using electronic data, the merchant can consider its cost of acceptance to be 3%. The same rules apply to surcharging Mastercard-Branded Credit Cards at the product level.

- Surcharging Visa but not Mastercard, and Vice-Versa: The Settlement Agreement provides that, subject to the rules described above, a merchant may surcharge Visa-Branded Credit Cards (at the brand or product level) but not Mastercard-Branded Credit Cards (at the brand or product level), or surcharge Visa-Branded Credit Cards at one level (brand or product) and surcharge Mastercard-Branded Credit Cards at a different level (brand or product), and vice versa, in any combination.

- No-Discounting and Non-Discrimination Rules: Visa and Mastercard will modify their “no discounting” and “non-discrimination” rules to clarify that merchants may offer discounts to their customers at the issuer level, i.e. discounts that vary by the issuing financial institution of the credit or debit card.

In plain English:

- You still can’t surcharge more than 3% even if your cost of acceptance is higher than 3% (it happens)

- You can’t practically surcharge any card brand (e.g. Visa) more than any other card brand (e.g. Mastercard)

- Technically any surcharging is still impermissible if the merchant accepts Amex

So, in effect, no actual benefit to merchants.

Shocker.

This is how absurd this whole thing is.

Imagine you’re in the market to buy a car and you want a lower price.

You: What’s the best you can do on price?

Car dealer: How about I call a random person in India?

You: Huh? What’s that have to do with anything?

Car dealer: I know: I’ll eat a salad for lunch tomorrow!

You: Are you f*cking high? What is wrong with you?

This conversation, in essence, summarizes the entirety of this settlement.

Here’s your Chat GPT summary of the Visa, Mastercard settlement:

- After 20 years of litigation there’s no practical change and merchants will continue to get screwed

- The lawyers are the real winners, reaping billions of dollars despite a useless outcome

- Visa and Mastercard will continue making unlimited money via non-Interchange fees (i.e. dues and assessments)

- Small merchants on flat-rate pricing will see any potential benefit accrue to their processors

- Zero practical changes to surcharging despite the lip service

Payments: Infinity.

Merchants: Zero.