Utility Bill Payment Kiosk Solutions (Verizon Bill Pay Kiosk & AT&T Bill Pay)

Update Nov21 — New review of AT&T bill pay kiosks along with Verizon and Xfinity Comcast — link to feature

Payment kiosk — From KIOSK – 2013 statistics from the FDIC report 7.7% of households in the United States as unbanked (9.6 million households). Further, a full 20% are underbanked – meaning they have a bank account but also use alternative financial services outside of the banking system.

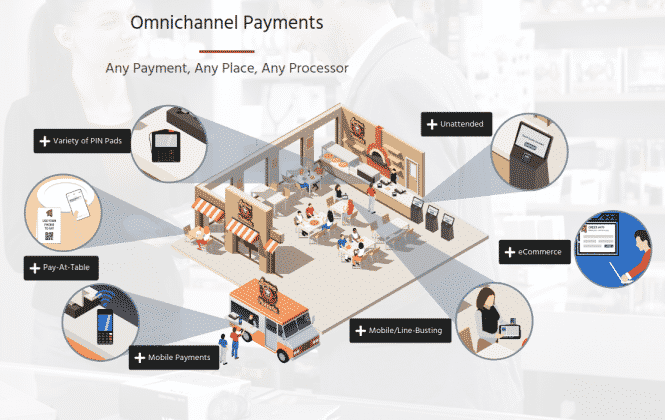

includes payment kiosk projects such as AT&T Bill Pay, Verizon Bill Pay, Sprint, and T-Mobile. New markets for payments include Bitcoin ATM Kiosks, Contactless Payment, Mobile Phone Integrations and markets like Cannabis Kiosks (aka Marijuana kiosks). The usual locations for bill payment or interacting with payment devices starts with your supermarket, the airport, and restaurants (the above feature omnichannel payment image courtesy Datacap Systems, Inc.)

Additional markets include DMV Kiosks, Utility Bill Pay, Correctional Intake Kiosks, Alimony kiosks.

For reference

ATT Customer Service

Payment Kiosk Solution Providers

- Olea Kiosk – kiosk manufacturer with a wide range of bill payment options. Olea also has a dedicated website specifically for payment kiosk.

- KioWare – kiosk software supporting billing devices

- Pyramid – kiosk manufacturer with a wide range of bill payment options

- Nanonation – kiosk software for bill payment and utility payment. Provided base software for Comcast Bill Payment systems doing checks, credit cards and more.

- KIOSK – kiosk manufacturer – kiosk payment customers include Verizon Bill Pay, AT&T, Comcast and many more. A

- Self-Service Networks – Cash2Card and Gift Card Solutions

Payment Devices (aka Cardholder Activated Terminals or CATs)

- UCP Inc. – EMV certified devices & gateway provider

- Datacap Systems Processors, Gateways PA DSS Certified, 3rd Party Integrations

- Ingenico

ROI Rationale — Verizon has answered the call for a faster way for its customers to pay wireless bills. Nearly all Verizon Wireless Communications Stores feature Verizon bill payment kiosk payment stations, a fast and easy way for customers to manage their wireless mobile bills. The kiosks cut wait times drastically for customers who prefer to make in-store bill payments. The kiosks are very much like ATM machines, but instead of dispensing money they collect kiosk payments (Hey, that’s sounding pretty good already…) and they can apply credit to the customers’ wireless accounts. The machines accept cash, credit cards, personal checks and gift cards. Cash back. No interchange fees.

Payments can be posted for either a customer’s monthly service plan or for pre-pay service plans. The pay kiosks which are accessible during store hours-require only the customer’s account number and the establishment of a PIN number. Payments post immediately after the transaction is complete. The kiosk system proves advantageous to those who favor prompt, convenient transactions.

“The kiosks allow our customers to avoid waiting in line to make an in-store payment and give them greater flexibility and control over their payments,” says Keith Slater, director of communications stores for Verizon Wireless’ Upstate New York Region.

The immediacy of a kiosk payment can be beneficial in a number of situations:

- Customers can easily avoid late payment fees for a bill they may have overlooked.

- The parents of a college student would be able to make payments for their child, using the kiosk to help with the student’s finances.

- Customers who frequently travel for business or take vacations could use kiosks nationwide to manage their accounts.

- A family member of a customer who unexpectedly falls ill, or may be confined to the home (such as an expectant mother or someone with an injury) could pay the bill by using the kiosk.

As an added incentive to customers who use the bill payment kiosks, receipts from kiosk transactions often include special offers and promotions.

Verizon Bill Payment Case Study – Mobile Bill Payment

“The kiosks help us manage the flow of traffic through our stores more effectively and provide our customers with a much easier, quicker way to manage their wireless accounts,” says John Palmer, president of Verizon Wireless’ Upstate New York Region.

Verizon bill payment kiosks generally take cash, check or credit card. Coin is not an option. The customers are entirely mobile phone owners and their payments are generally in cash mostly with some credit and maybe 20% in old fashion checks.

- Parcel Locker and Smart Lockers

- Credit Card Interchange Settlement — Who Came Out Ahead?

- Surplus Kiosk Parts & Gaming Parts For Sale

- Self Ordering Kiosk AI Assist – Clover

- ADA News – DOJ Title II final rule

- ECOATM News

- InfoComm 2024 – June 8th Las Vegas

- Press Release – Kiosk Industry April 2024

- Digital Gift Card Report Blackhawk

- Bitcoin ATM Kiosk Market Update – Crypto

- European Accessibility EAA Guidelines & Storm Interface

- New Indoor Kiosks Doubles as an Outdoor Kiosk

- Labor Challenges and Restaurants Doubling Down on Kiosks

- Kiosk Software News – DynaTouch acquires KioWare

- Electronic Lockers – Amazon Hub, USPS & Smartecarte

Bill Payment related information:

- Kiosk Information Systems Financial Services webpage

- VDC Self-Service Kiosk executive brief

- Benefits of Bill Pay Kiosk by US Payments – Original link – https://www.uspayments.com/WhitePapers/US-Payments_SR_Bill-Pay-for-Retailers_To-Launch.pdf

- Kiosk Market 2015 by Transparency Research

- Kiosk Market 2014 by CAKCEK

- Kiosk Cash Recyclers

- Tablet Kiosk Software

- Kiosk Mode Software for Secure Browser

- Android Kiosk Software

- https://kioskindustry.org/terms/

- Financial Kiosks category

- Bill Payment Kiosk Components Devices