Last Updated on April 7, 2025 by Staff Writer

Kiosk Financing – A look at the changes with Tax Reform Act

Note: thanks to Impresa Financial for contributing

The Tax Cuts and Jobs Act recently signed into law includes multiple provisions which encourage businesses to invest in kiosk financing, self-service and automated technology equipment in the 2018 tax year. These include:

Immediate Expensing

100% immediate expensing (bonus depreciation) is available for certain business expenses including machinery and equipment and qualified improvement property acquired and placed in service after

September 27, 2017. The provision applies to both new and used property. The 100% expensing is available through 2022, after which it begins phasing out by 20% per year. Bonus Depreciation is useful to very large businesses spending more than the Section 179 Spending Cap (currently $2,500,000) on new capital equipment.

Enhanced Section 179 Deduction and Depreciation

The popular Section 179 deduction has been increased from

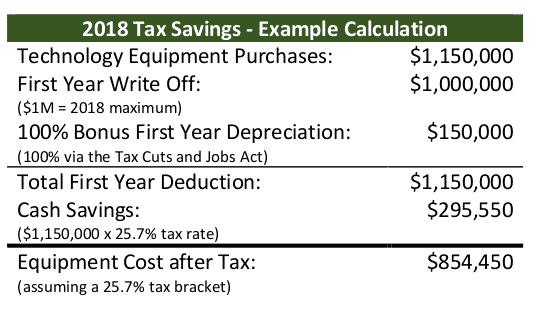

$500,000 to $1 million with the phase-out limitation increasing from $2 million to $2.5 million for tax years beginning after December 31, 2017. These amounts are indexed for inflation for years beginning after 2018. All businesses that purchase, finance, and/or lease less than $2,500,000 in new or used business equipment during tax year 2018 qualify for the Section 179 Deduction.

What this means for buyers of kiosks and other self-service technology equipment: There has never been a better time to invest in kiosks and self-service technology.

Buyers can write off 100% of the solution’s cost in the tax year of purchase. Additionally, if they elect to finance the purchase, they can pay for it over multiple years.

For more information, you may consult the following sources:

• U.S. House of Representative, Committee on Ways and Means (https://waysandmeans.house.gov/tax-cuts-jobs-act-resources/)

• Internal Revenue Service (https://www.irs.gov/newsroom/tax-reform)

• The Tax Cuts and Jobs Act, H.R.1 — 115th Congress (2017-2018) (https://www.congress.gov/bill/115th-congress/house-bill/1/titles)

• Section 179 (http://www.section179.org/section_179_deduction.html)

If interested in more information on kiosk financing options please visit Impresa Financial and speak with Kelly.