Key Points from Yahoo Finance: Bitcoin Depot Rides on Kiosk Expansion

-

Rapid Kiosk Expansion: As of March 31, 2025, Bitcoin Depot had installed 8,463 Bitcoin ATM (BTM) kiosks across the United States, Canada, and Puerto Rico. Plans are underway to surpass 10,000 kiosks after acquiring over 2,300 additional machines, pushing market leadership in North America123.

-

Revenue Growth: BTM kiosks accounted for about 99.7% of the company’s income in Q1 2025, reflecting Bitcoin Depot’s dependence on kiosk-based transactions. The typical transaction size at its kiosks is around $3001.

-

Strategic Acquisitions and Partnerships: In June 2025, Bitcoin Depot acquired Pelicoin, LLC, increasing its presence in Louisiana, Tennessee, Alabama, Texas, and other states in the Gulf South. Partnerships with retail giants—like CEFCO (covering 72+ locations) and EG America LLC (900+ sites)—drive further expansion145.

-

New Business Models & Growth Initiatives: The company launched seven franchise profit-sharing agreements and continues to pursue profit-sharing, providing incentives for partners to host kiosks. These strategic moves are designed to increase transaction volume and revenues16.

-

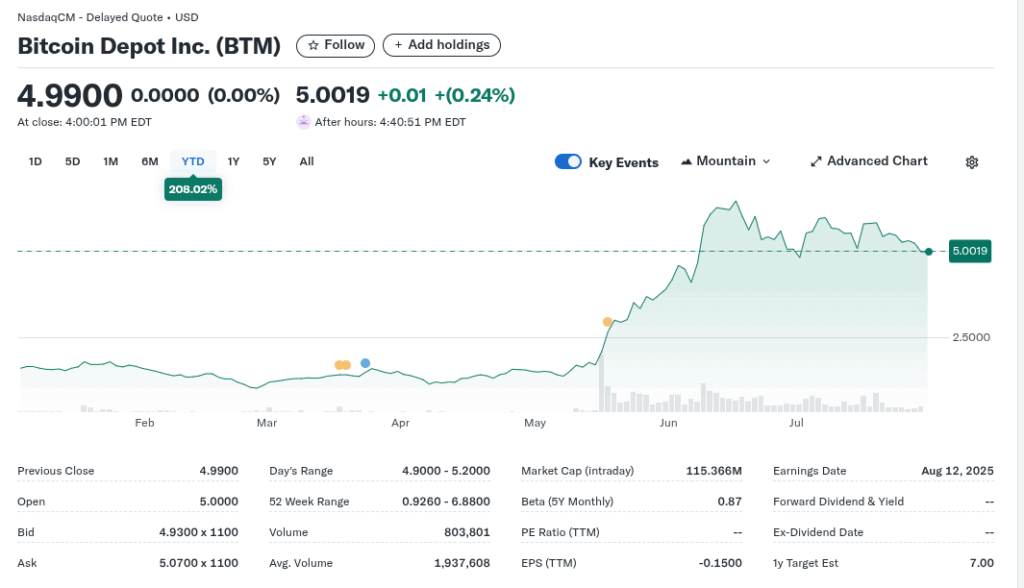

Strong Stock Performance: Bitcoin Depot’s stock surged 228% year-to-date, significantly outperforming the S&P 500’s 8.3% gain. Earnings projections for 2025 expect a 176.7% year-over-year increase, indicating robust investor optimism1.

-

Treasury and Crypto Holdings: Bitcoin Depot adopted a strategy of holding over 100 Bitcoins as a treasury reserve, demonstrating confidence in cryptocurrency’s long-term value as an asset1.

-

Favorable Regulatory Environment: Recent regulatory easing—such as clarification from the SEC and the FDIC, along with a strategic crypto reserve order from the U.S. government—has created tailwinds for further growth, benefiting Bitcoin Depot and other crypto-related companies6.

-

Competitive Landscape: Competitors like Coinbase focus on stablecoins and staking services, while BTCS emphasizes Ethereum. However, Bitcoin Depot is carving out a unique niche in physical Bitcoin ATM services1.

In summary, Bitcoin Depot is experiencing record growth due to strategic acquisitions, aggressive expansion of its kiosk network, and supportive regulatory trends, propelling both its revenues and stock performance higher1645.

Excerpt

As of March 31, 2025, Bitcoin Depot had 8,463 BTM Kiosks installed across the United States, Canada and Puerto Rico, with a median kiosk transaction size of $300. Further, in June 2025, the company acquired the assets of Pelicoin, LLC, to strengthen its presence in the Gulf South region of the United States. The transaction will expand kiosk locations across Louisiana, Mississippi, Tennessee, Alabama and Texas.

Bitcoin Depot’s close peers like Coinbase Global Inc. COIN and BTCS, Inc. BTCS have been capitalizing on cryptocurrency tailwinds. While Coinbase has been emphasizing stablecoins and staking services, BTCS focuses on an Ethereum-focused strategy.

The recent wave of deregulation in crypto policies is expected to favor companies like Bitcoin Depot, Coinbase and BTCS by reducing compliance burdens and opening up new revenue opportunities.