OTI Brings Diverse Cashless Payment Solutions to Worldwide Merchants

INTRODUCTION TO OTI

BUSINESS CHALLENGE – CASHLESS PAYMENTS

Automated retailers, Internet of Things (IoT) providers, fuel management companies, mass transit ticketing organizations, and many other industries need secure cashless payment systems to deliver their business objectives. Approximately 45% of transactions in the United States are cashless today, and Sweden expects to be completely cashless by 2020. Cashless transactions already exceed cash in Belgium, France, Sweden, the United Kingdom, and other European countries.

BUSINESS CHALLENGE – OTI

OTI’s business spans hardware, software, and mobile solutions for cashless payments. OTI has over 700,000 hardware devices installed worldwide, supporting markets such as vending, micro-markets, banking and ATMs, petroleum and fuel hardware, ticketing, IoT, wearable devices, and more.

With around 40% market share in the U.S., OTI needed a U.S.-based payment partner to provide secure processing in combination with OTI’s payment capture solutions.

One example, OTI’s TRIO is a modular payment device which supports up to three cashless payment interfaces in one enclosure. The TRIO is specifically designed for installation in unattended environments such as kiosks and vending machines to enable cashless payments with magnetic payment cards, as well as mobile (NFC payment options such as Apple Pay®, Google Pay, Samsung Pay®), EMV chip and contactless payment cards. To deliver this hardware to the U.S. market, OTI needed a payment partner offering state of the art security with end-to-end encryption, tokenization and EMV capabilities.

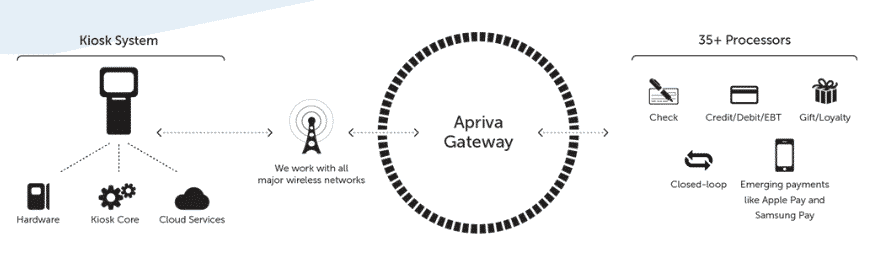

In another example, otiKiosk provides kiosk system developers with an easy and affordable way to integrate a pre-certified EMV payment acceptance solution into their system, and additionally provides kiosk operators with remote management of their hardware and software. This OTI hardware solution incorporates EMV secured payment acceptance for quick service restaurants (QSRs) and other businesses, supporting mobile payments, credit cards and debit cards. To deliver this to the U.S. market, OTI needed a payment technology partner who could process mobile,

“The OTI and Apriva cashless payments solution was the perfect choice for us. The flexibility to manage both our EASE and CloudEASE portfolios with the same SDK, combined with the efficiency of an off-the-shelf, pre-certified EMV solution not only gave Parking BOXX a time-to-market advantage,but also saved us the cost of months of integration and certification.”

~Renee Smith, President and CTO, Parking BOXX

CHOOSING APRIVA

OTI selected Apriva among the many options for partnering in the U.S. market. With Apriva’s adaptive payment platform, OTI gained a processing partner with the ability to facilitate the broad range of payments OTI’s customer base required. With a secure end-to-end encryption model, and multiple EMV certifications already completed, Apriva was a strategic fit to OTI’s North American operations.

OTI was impressed with Apriva’s payment APIs for quick integration for the OTI’s TRIO and otiKiosk hardware, and with the superlative technical support that accompanied those integrations. Plus, Apriva’s technology platform allows OTI to expand its U.S. business—leveraging Apriva’s network of more than 1,100 merchant acquirers and independent sales organizations (ISOs).

“Apriva is an excellent fit for our cashless payment solutions, as they offer a world-class gateway with multiple secure options,” said Bill Gostowski, Vice President of Business Development at OTI.

“Our cost-effective hardware and software solution pairs strongly with Apriva’s secure payment capabilities and we are pleased to bring an unattended solution to market built upon our combined technologies, experience and success.”

SOLUTION – OTI & APRIVA

In 2017, OTI and Apriva partnered to bring a new end-to-end EMV solution to the U.S. market supporting unattended payments. This payment solution supports magnetic stripe reader (MSR) transactions, as well as EMV contact and contactless transactions with Elavon as acquiring bank. As a semi-integrated solution, the OTI TRIO reader is securely interfaced with the Apriva gateway, which means a quick integration process for unattended payment environments. Security includes real-time, end-to-end data encryption, using the industry standard derived unique key per transaction (DUKPT) encryption method, with no cardholder or card data stored.

In 2018, OTI combined its otiKiosk solution set with Apriva’s adaptive payment platform to bring vendors, micro market merchants, automated retailers and other unattended businesses unmatched value, flexibility, and ease of integration—saving thousands of dollars, many months in development time and certification costs.

“The addition of pre-certified EMV processing to the OTI/Apriva Kiosk Solutions brings incredible value to both our current and future customers. This timely and relevant EMV solution is easy to install, even for kiosk solution providers with no previous cashless payment experience.”

~Shlomi Cohen, CEO of OTI

The pairing of otiKiosk and Apriva delivers a pre-certified, off-the-shelf EMV solution binding a powerful unattended system with secure payment processing technology. This partnership helps businesses eliminate the cost and complexity of integration and EMV certification for unattended, cashless processing. OTI brings an integrated cloud-based Terminal Management Solution package, responsible for remote terminal management and financial reporting, and Apriva brings payment technology built on a security foundation that has been deployed by the US Intelligence Community, Department of Defense (DoD), and is compliant with the payment industry’s standards body, the PCI Security Standards Council.

MOVING FORWARD

Together, OTI and Apriva continue to focus on the ever-growing unattended market with their integrated payment solutions. OTI’s best-in-class hardware and software solutions, combined with Apriva’s adaptive payment platform, brings OTI customers unmatched value, flexibility, and ease of integration.

The partnership delivers an affordable, EMV solution for automated markets. Unattended retailers, micro-markets, vendors and other self-service merchants can increase their revenues by accepting more forms of cashless payments, easily integrated via Windows or Linux SDK, and potentially reducing PCI scope through Apriva’s secure end-to-end encryption (E2EE) technology.

As unattended payment options expand in the years ahead, OTI’s success with hundreds of thousands of readers in the field worldwide aligns tightly with Apriva’s vision for supporting those payments.

“Secure, customer-focused unattended payments are critical to AR Systems. OTI’s payment hardware and Apriva’s payment gateway are key partners in AR Systems’ application of intelligent computing, cloud-based monitoring and robotic solutions to evolve vending into a robust premium retail solution.”

~ Shannon Illingworth, Chief Innovation Officer at AR Systems

Reference links: