Fast-casual places are ditching cash for safety and efficiency. Critics say this shuts out poor people, some immigrants and those who just prefer cash.

Source: www.washingtonpost.com

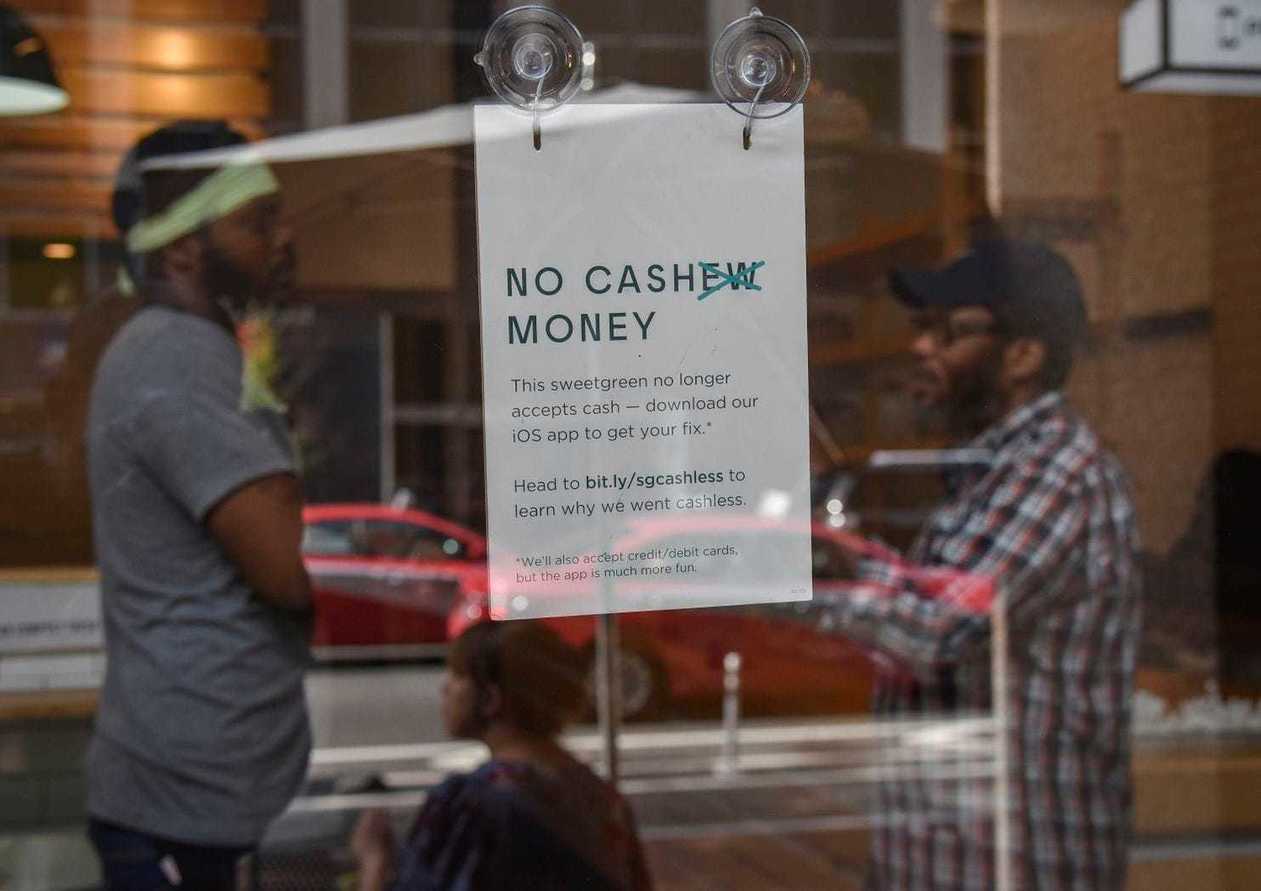

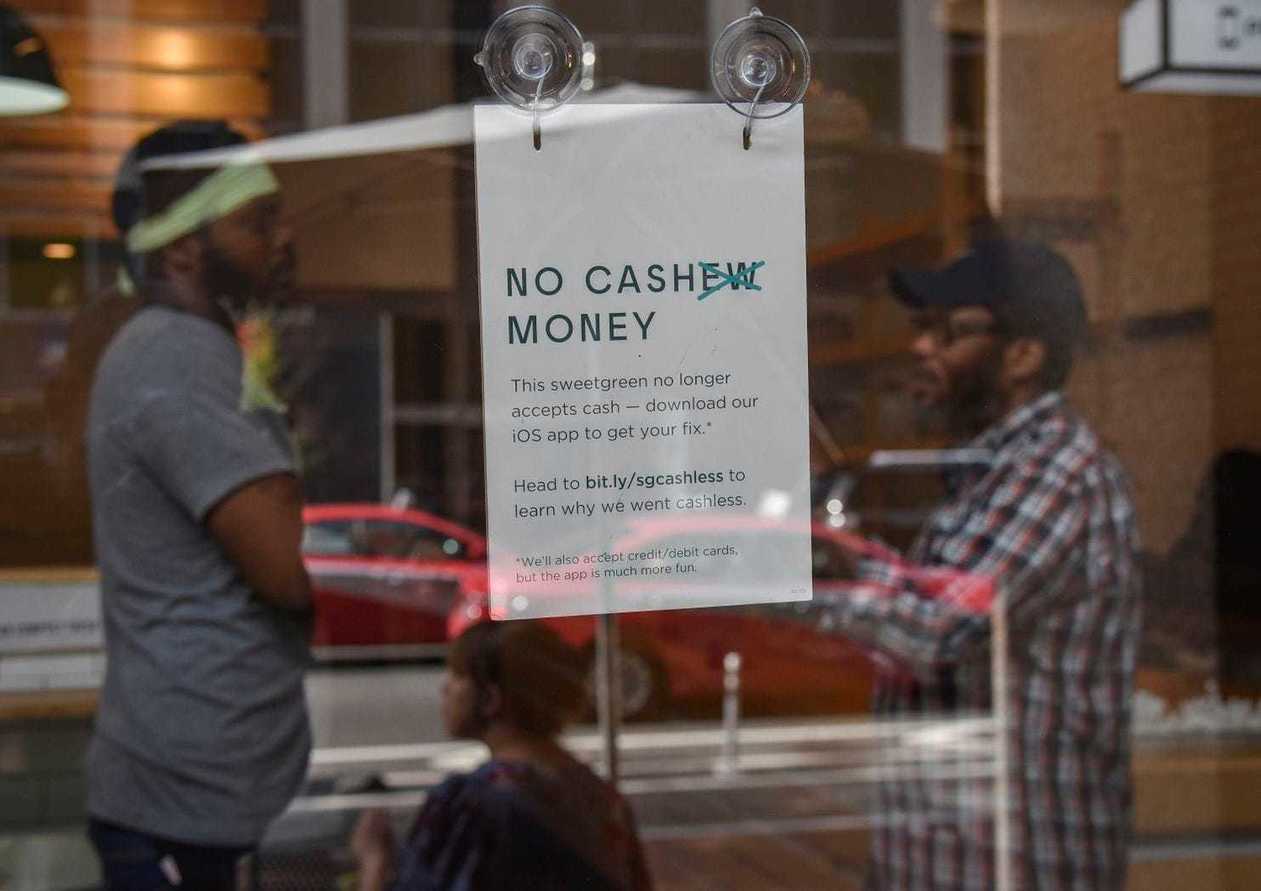

The global cashless movement has reached Washington, where a growing number of fast-casual establishments and other spots are saying no to greenbacks in favor of plastic and mobile payments. Sweetgreen, the national salad chain founded by Georgetown University graduates, went cashless in most of its locations last year. Other cashless spots include a Menchie’s frozen-yogurt shop downtown, the posh Barcelona Wine Bar on 14th Street NW and the Bruery beer store at Union Market.

Soon, they may be breaking the law.

The decision to go cashless also has broader implications in the global battle between the credit-card and ATM industries.

Perhaps unsurprisingly, Visa has been a major booster of the cashless movement. The credit card company in March awarded 50 businesses $10,000 each for rejecting cash payments and has released reports touting the benefits of a cashless society.

Comments: This will be a very interesting fight over the next decade. Governments obviously want no cash, as an all electronic economy means every transaction everywhere is known to it.

The push back due to the unbanked was quite predictable. However, when you see a country like India has gone cashless in many spots — well, if they can figure out how to do it, we should be able to figure out how to do it. I believe even poor countries in Africa have large cashless segments now.

This really is not a battle of if, but rather when.