Last Updated on March 6, 2026 by Staff Writer

Recent developments in self‑service technology for major restaurant chains

Here’s our SST summary (January 25, 2026) focused on meaningful recent developments in self‑service technology for major restaurant chains (kiosks, conversational/voice AI, drive‑thru AI, robotics/automation, computer‑vision, and app/mobile ordering):

Key Recent Developments

AI & Drive‑Thru Ordering

- McDonald’s continues expanding AI applications in 2026, integrating AI across operations—improving drive‑thru accuracy and exploring voice AI ordering systems. (TheStreet)

- Industry analysis indicates 2026 will be a pivot year where AI transitions from experimental to operational necessity for efficient restaurant workflows. (QSR Web)

Robotics & Automation

- White Castle’s new prototype restaurant includes robotic fry cooking, drive‑thru voice AI, and self‑order kiosks, signaling tangible robotics use in QSR concepts. (Restaurant Dive)

- Dave’s Hot Chicken is advancing its AI and automation strategy as it scales, reflecting broader fast‑casual tech adoption. (Restaurant Technology News)

Strategic Investments & Partnerships

- Chipotle and Cava invested $25M in automation platform Hyphen to advance meal production automation—an example of cross‑brand SST investment. (Restaurant Technology News)

Notable Market & Tech Signals

- Market trend reporting projects self‑service ordering and AI systems are reshaping engagement and operational workflows across major chains through 2026. (Self Service Kiosk Machine)

- Platforms delivering self‑service kiosks with enhanced AI, dynamic upsell, and reduced wait times are now seen as revenue channels, not just labor saves. (Restaurant Technology News)

- Voice AI is advancing from pilot phase toward practical deployment across drive‑thru and self‑service interactions in 2026. (Ordering Stack)

Summary Snapshot

What’s Moving the Needle

- AI at scale: Leading brands (McDonald’s, Yum Brands affiliates) are integrating AI deeper into drive‑thru, order accuracy systems, and broader operational functions.

- Robotics in build‑out: Prototypes (e.g., White Castle) with robotics and automation suggest some chains are investing in physical automation beyond digital ordering.

- Cross‑brand collaboration: Strategic investments like Chipotle/Cava in automation platforms indicate SST solutions gaining financial backing.

- Self‑service evolution: Kiosks and digital ordering systems are increasingly tied to upsell, personalization, and operational insights.

Sources

- McDonald’s AI expansion plans and strategic context — TheStreet / tech press. (TheStreet)

- Automation investment by Chipotle and Cava — Restaurant Technology News. (Restaurant Technology News)

- AI/automation adoption at Dave’s Hot Chicken — Restaurant Technology News. (Restaurant Technology News)

- Industry’s AI transition outlook — QSRWeb analysis. (QSR Web)

- Restaurant prototype with robotics (White Castle) — Restaurant Dive. (Restaurant Dive)

Conclusion:

There are meaningful SST updates in recent months—especially around AI integration at scale, robotics prototypes in QSR settings, and industry insight pointing to 2026 as a tipping point for AI and automation adoption across the Top 50 restaurant ecosystem.

Featured

Recent Acrelec SST Initiatives

🤖 1. Strategic Voice AI Drive-Thru Partnership

-

SoundHound AI and Acrelec partnered to integrate advanced voice-enabled drive-thru systems globally. This combines SoundHound’s voice AI with Acrelec’s digital signage/kiosk hardware, aiming to modernize drive-thru order taking and streamline operations. The offering connects directly to the POS to process automated orders.

🌍 2. Leadership & Growth Phase for 2026

-

Acrelec’s role within its parent Glory Group has shifted toward being a core growth engine for unified commerce in foodservice automation, signaling a move from innovation experimentation toward enterprise-grade deployments at scale.

🖥️ 3. Continued Rebrand & Market Expansion

-

In early 2025 Acrelec unveiled a brand refresh and repositioning as a leader for comprehensive self-service experiences — including kiosks, drive-thrus, and checkout tech — with a large global install base and ongoing focus on restaurant customer experience innovation.

📊 4. Global Deployment Signals

-

Acrelec’s kiosk technology is widely deployed across airports and high-traffic venues — showing ongoing real-world SST footprint growth with customizable digital kiosks and integrated software for seamless ordering workflows.

📍 Why This Matters for SST Trends

Acrelec sits at a strategic intersection of hardware (kiosks, digital signage), software (content/experience management), and emerging AI-augmented drive-thru voice experiences. That makes it a key global SST enabler for major restaurant brands — not just a kiosk hardware supplier.

1. What’s real vs. still experimental

-

-

-

Live at scale now

-

McDonald’s AI push: drive‑thru AI, kitchen monitoring, and data/decision systems expanding globally in 2026, built on Google Cloud infrastructure and internal tools.

-

Self‑order kiosks, loyalty‑driven apps, and AI‑assisted upsell logic across big brands (McDonald’s, Yum, Chipotle, Cava, etc.) are standard, not pilots.

-

-

Scaling but not universal

-

Dave’s Hot Chicken “tech stack”: AI voice, kiosks, robotics, and data tooling layered over a modern POS/edge architecture as they pass 300 locations.

-

Hyphen automated makelines: Chipotle + Cava’s 25M stake shows serious interest, but installs are still in early phases vs. chain‑wide defaults.

-

-

Prototype / lighthouse

-

White Castle “Castle of Tomorrow”: robotic fryers, drive‑thru voice AI, and heavy automation are in a handful of concept stores, not yet an economic proof at national scale.

-

-

-

2. Practical architecture patterns

Think in layers rather than products:

-

-

-

Edge + POS layer

-

Modern, API‑friendly POS (Qu, Toast‑class systems, or custom for megachains).

-

Local edge hardware for latency‑sensitive tasks (drive‑thru audio, vision, kiosk UI).

-

-

Experience layer

-

Kiosks, menu boards, mobile apps, web ordering, drive‑thru HMI.

-

Vendors like Acrelec bundle hardware + CMS + menu logic for this layer.

-

-

AI & automation layer

-

Voice AI: SoundHound, in‑house engines, or other ASR/NLU tied directly into POS.

-

Robotics/automation: Hyphen makelines, fry robots, order‑accuracy cameras.

-

-

Data & control layer

-

Cloud analytics (Google, Azure, etc.), demand forecasting, upsell engines, labor and inventory optimization.

-

-

-

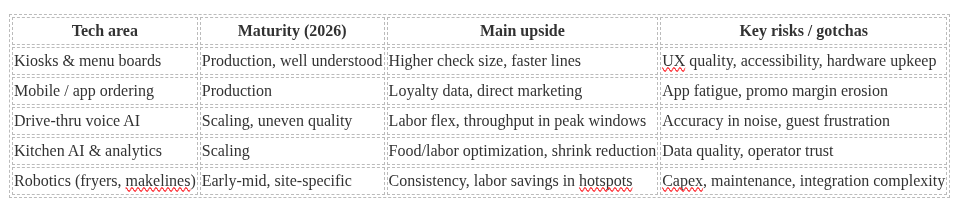

3. Maturity and risk by tech

4. Where to bet vs. wait (next 24–36 months)

-

-

-

Bet now (if you’re multi‑unit/QSR/FCR)

-

Kiosks + integrated menu boards tied to loyalty and POS.

-

Basic AI‑driven recommendations (cross‑sell, time‑of‑day offers) and line‑busting via mobile/web.

-

-

Pilot carefully

-

Drive‑thru voice AI with clear fall‑back to human and strong monitoring (accuracy, handle time, defection rate).

-

Kitchen analytics and forecasting tools that plug into your existing POS and inventory with minimal custom glue.

-

-

Wait‑and‑see / selective lighthouse

-

Heavy capex robotics unless you have sustained volume, tight menu, and a strong in‑house tech/ops champion (Hyphen‑style makelines, full robotic fry stations).

-

-

-

5. Implementation checklist

When evaluating anything that looks like what’s in the update, consider:

-

-

Integration: “Show me the live POS and kitchen integration, not the slide.”

-

Numbers: “How many stores? What’s the measured lift in sales, speed, or accuracy?”

-

Ops fit: “What breaks when it’s Saturday night, raining, and the drive‑thru wraps the building?”

-

BOTTOM LINE

- Many SST deployments in 2025 failed to meet expectations due to integration gaps, data quality issues, and change management—not technology limitations.

-

What matters for QSR vs Fast Casual vs Full Service?

-

Which SST investments are table stakes vs optional?

-

QSR: speed + accuracy + automation

-

Fast Casual: personalization + mobile-first

-

Full Service: ops intelligence + staff augmentation

-

- So What? Or What decision does this force me to make?

-

This means brands without a drive-thru AI roadmap by 2026 will fall behind on throughput benchmarks.

-

Operators should expect kiosks to shift from labor replacement to revenue optimization tools.

-

- The big 2026 trend is kiosks talking to mobile apps and kitchen display systems (KDS) as one single brain, rather than separate silos.

- “Privacy by Design.” Edge AI keeps data local, consider the massive legal and PR pain point (GDPR/CCPA compliance) that makes this a “must-have” for C-suite approval.

- The new trend is “User-Replaceable Parts”—if a printer jams or breaks, a 19-year-old shift lead can swap the module in 30 seconds.

- Executive Trends

- Financials : Kiosks must achieve >20% AOV lift to justify the CAPEX.

- Reliability Offline First: Systems must function during “internet blackouts” via Edge compute.

- Labor Hospitality: Automation is the “Shield” that protects staff from burnout during rushes.

- Security and Biometrics and Privacy: Facial recognition must be opt-in and processed locally to avoid lawsuits.