Selecting an OS for your Kiosk

When we ask kiosk manufacturers which OS do they prefer, we always know the answer — “Whatever the client asks for…”. Having said that it is hard to escape the legacy in kiosks that Windows has created, and in digital signage as well. Point of Sale and Vending for that matter. Thanks to Traci at Vispero for requesting.

What are the odds of the next kiosk being delivered using Android? Much higher than legacy Windows. Some reasons:

- Android is cheaper. Windows is only cheap for low end processors. Which means it is irrelevant. Why pay $35 just to run on a J1900 Celeron?

- Patch management — When was the last time your PC updated it windows software? How long did it take? Even with LTSB it is painful.

- Device support for payment has matured to include Android — cash recyclers now support Linux and Android

- The use of peripheral devices is a declining ratio. Devices are no longer standard options so much as specialized

- Reliability and uptime — for mission critical you are more likely to find Linux. Windows is designed for daily use not long term.

Let’s check with our AI buddies why don’t we…

Here is Anthropic

Context and caveats

Most kiosk market reports segment by “Windows / Android / iOS / Other” rather than giving precise percentages, but multiple analyses agree Android is now the largest kiosk OS segment, with Windows second. “Other” typically bundles embedded Linux, ChromeOS, and proprietary platforms. General desktop and device OS statistics confirm that, outside kiosks, Windows dominates traditional PCs while Android dominates embedded/touch and low-cost hardware, which mirrors what integrators report for kiosks and digital signage.

Working estimate (global installed base, interactive kiosks + signage)

As a rough, order‑of‑magnitude split for kiosk-type deployments today:

-

Android: ~40–50%

-

Windows: ~25–35%

-

Linux (non‑Android): ~10–20%

-

ChromeOS: ~5–10%

These ranges reflect that Android is cited as holding the largest kiosk OS share in multiple market segmentations, while Linux and ChromeOS are specifically highlighted as growing choices for custom industrial kiosks and managed signage, but still smaller than Windows and Android. Where budgets favor commodity ARM hardware or tablets, Android dominates, while banking, ticketing, and legacy retail kiosks still skew heavily to Windows, and education/retail signage is a key beachhead for ChromeOS.

How to use these numbers

For planning or product strategy, those ranges are accurate enough to:

-

Prioritize Android and Windows first for kiosk software support and management tooling.

-

Treat Linux as important for industrial/custom deployments and large signage networks.

-

Consider ChromeOS as a growing but still minority platform, especially in managed, cloud‑centric environments like education and QSR signage.

If you share what kind of kiosks you care about (retail, QSR, transit, healthcare, banking), a more tailored breakdown with narrower ranges is possible.

ChatGPT

Short answer: there’s no clean, published “official” breakdown, so any numbers here are reasoned estimates, not hard facts. But we can get to a plausible range by triangulating from kiosk, POS, and digital-signage OS data and what vendors actually ship.

I’ll frame this as global installed base of interactive kiosks (QSR, retail, ticketing, healthcare, gov, etc.), excluding ATMs and classic POS terminals.

Big picture

Approximate global kiosk OS share (installed base, 2025-ish):

-

Windows: 45–55%

-

Android: 25–35%

-

Linux (incl. custom/embedded): 15–20%

-

Chrome OS / ChromeOS Flex: 3–5%

I’ll explain why these ranges make sense.

Why Windows is still #1 (but declining)

Signals:

-

Most long-lived kiosk fleets from the 2010s (QSR, ticketing, transportation, gov) were built on Windows 7/8/10 IoT / Embedded. OEMs like NCR, Diebold Nixdorf, and many kiosk enclosure vendors still default to Windows for complex, multi-peripheral builds (scanners, EMV, printers, biometrics, etc.).

-

POS data is a decent proxy: for fixed-position terminals, Windows remains a major share in retail and hospitality even as Android grows faster.

Why not higher than ~55%?

-

A ton of new deployments (and refreshes) in QSR, c-store, micro-markets, EV charging, lockers, etc. are going Android-first or Linux-based, especially on ARM boxes and SoC displays.

-

Many older Windows 7/8 kiosk estates have been retired outright, not all re-platformed.

So: Windows is still the plurality leader, but it’s a shrinking share of a growing pie.

Why Android is gaining so much ground

Signals:

-

Most new tablet-style kiosks, ordering tablets, price checkers, check-in tablets, and small-format payment kiosks are Android.

-

Large SoC displays from Samsung, LG, Sony, Philips ship with embedded Android or Android-based firmware for signage and kiosk modes.

-

Payment/POS vendors (PAX, Sunmi, Castles, Ingenico TETRA/APOS, etc.) are heavily Android for smart terminals, and those often get repurposed as kiosks or semi-kiosks.

Why I cap it around 35% installed base:

-

Huge legacy of Windows boxes still out there.

-

A lot of Linux behind the scenes (more on that next).

-

Android dominates new units shipped in many verticals, but installed base lags shipments.

If you looked only at new kiosk shipments in 2024–2025, Android could realistically be 35–45% of new units, sometimes more in QSR and hospitality.

Linux: the quiet workhorse

Signals:

-

Many ticketing, transit, parking, EV charging, and vending / micro-market controllers run hardened Linux (often never marketed as such).

-

Most of the “appliance-like” kiosks (EV chargers, parking meters, transit validators, smart lockers) heavily favor Linux for cost, security, and headless/edge-compute flexibility.

-

Large digital signage CMS vendors support Linux players (BrightSign-style appliances, Raspberry-Pi-like boxes, Intel/ARM players) which frequently double as kiosks or hybrid interactive displays.

That’s why I put Linux at roughly 15–20% installed base:

-

It’s absolutely dominant in some sub-verticals (EV, parking, transit), but those categories are smaller than retail/QSR by unit count.

-

It’s undercounted because many operators never label the OS in marketing material.

If you restricted the view to “infrastructure kiosks” (EV, parking, ticketing, transit), Linux can easily be 30–40%+ in those slices.

Chrome OS / ChromeOS Flex: important niche, not mainstream

Signals:

-

Chrome OS is attractive for education, simple check-in, and browser-only kiosks, and ChromeOS Flex gives IT an easy way to repurpose PCs as secure browser terminals.

-

Google has official kiosk mode and managed guest session options, but its emphasis is more on shared workstations and education than full-peripheral retail kiosks.

Why only 3–5%?

-

Limited device SKUs with integrated peripherals; you’re often pairing Chrome devices with USB peripherals in ways that Windows and Linux handle more maturely.

-

Most serious kiosk integrators still standardize on Windows/Android/Linux where device and driver support is deeper.

Chrome OS is strongest where IT wants strict browser control and low admin cost and doesn’t need heavy peripheral complexity.

How I’d use these numbers in your world

If you’re talking to analysts, OEMs, or sponsors, I’d describe it like this:

“In kiosk OS share, Windows still owns roughly half the installed base globally, especially among older, full-size kiosks with complex peripherals. Android is the growth engine, driving perhaps a third of installed kiosks today and an even larger share of new shipments. Linux quietly powers many infrastructure kiosks—EV, transit, ticketing—likely in the high-teens overall. Chrome OS has a small but visible niche in education and browser-only deployments.”

Then you can nuance it by vertical:

-

QSR / Fast Casual / C-Store self-order: Windows legacy + fast-growing Android, some Linux.

-

Retail price checkers / small info kiosks: Android + Linux.

-

Transit / Ticketing / Parking / EV: Mostly Linux, some Windows, very little Android historically (but growing for EV).

-

Healthcare / Gov check-in: Historically Windows; Android now growing for tablet-style kiosks.

-

Education / libraries: Higher Chrome OS & browser-based presence than average.

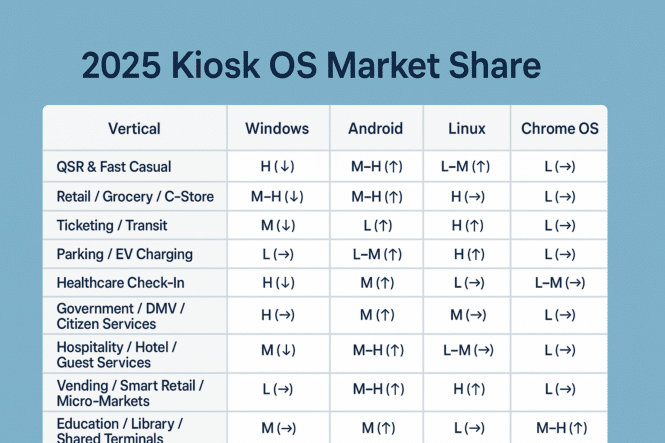

Kiosk OS Market Matrix (Installed Base & New Deployment Trend – 2025)

Legend

-

H = High share

-

M = Medium share

-

L = Low share

-

↑ = Growing

-

↓ = Declining

-

→ = Stable

| Vertical | Windows | Android | Linux | Chrome OS |

| QSR & Fast Casual | H (↓) | M–H (↑) | L–M (↑) | L (→) |

| Retail / Grocery / C-Store | M–H (↓) | M–H (↑) | M (→) | L (→) |

| Ticketing / Transit | M (↓) | L (↑) | H (→) | L (→) |

| Parking / EV Charging | L (→) | L–M (↑) | H (↑) | L (→) |

| Healthcare Check-In | H (↓) | M (↑) | L (→) | L–M (→) |

| Government / DMV / Citizen Services | H (→) | M (↑) | M (→) | L (→) |

| Hospitality / Hotel / Guest Services | M (↓) | M–H (↑) | L–M (→) | L (→) |

| Vending / Smart Retail / Micro-Markets | L (↓) | M–H (↑) | H (↑) | L (→) |

| Education / Library / Shared Terminals | M (→) | M (↑) | L (→) | M–H (↑) |

Recommendations

Bottom Line?

Windows

-

Strongest where fleets are older or require multiple peripherals.

-

Declining in QSR/retail but stable in gov/healthcare.

Android

-

The fastest-growing OS across almost all kiosk categories.

-

Leading OS for new small-format, tablet, SoC-display, and low-cost kiosks.

Linux

-

Dominant in infrastructure kiosks (EV, transit, parking, micro-markets).

-

Growing quietly due to appliance-style controllers and edge devices.

Chrome OS

-

Small but meaningful in education, libraries, and browser-only kiosks.

-

Growth driven mostly by ChromeOS Flex conversions.

Methadology — Where Do We Get Our Numbers

Worth noting the numbers above represent “number of units” deployed. Dollar volume is much different. Consider Samsung SOC running Linux or Android versus DMV Kiosk running Windows. Factor of 10 minimum.

Used to establish total unit ranges by vertical.

Typical sources:

-

Research & Markets

-

IMARC

-

IndustryArc

-

Omdia

-

KMA / Industry Group estimates

-

Regional transit, parking, and EV infrastructure studies

These tell us things like:

-

Total kiosks deployed by vertical

-

Growth rates

-

Regional distribution

➡️ They do NOT give OS, but they define the denominator.

Inferring OS

Examples:

-

NCR Voyix, Diebold Nixdorf → historically Windows

-

Acrelec, Pyramid, Olea, Advantech → Windows + Android + Linux options

-

Samsung / LG SoC displays → Android-based firmware

-

BrightSign-style players → Linux

-

EV charger OEMs → overwhelmingly Linux

Signals used:

-

Default OS in spec sheets

-

“Recommended OS” language

-

Supported OS lists

-

Long-term support commitments

POS & Smart Terminal OS Data (Proxy Signal)

POS OS data is one of the best indirect indicators for kiosks.

Why it matters:

-

QSR kiosks often reuse POS stacks

-

Payment peripherals track OS maturity

Sources include:

-

Android POS shipment growth vs Windows POS decline

-

Vendor roadmaps (PAX, Sunmi, Ingenico, Castles, Verifone)

➡️ This strongly supports Android growth and Windows legacy dominance.

Digital Signage OS Mix (SoC vs External Player)

Used for:

-

Retail info kiosks

-

Price checkers

-

Wayfinding

Signals:

-

Android dominates SoC signage

-

Linux dominates external media players

-

Windows used mainly when interaction + peripherals are heavy

This is where Linux’s share is often undercounted in casual analysis.

Vertical-Specific Infrastructure Data

Critical for Linux weighting.

Examples:

-

EV charging → Linux almost universal

-

Parking meters → Linux dominant

-

Transit fare/ticketing → Linux dominant

-

Vending controllers → Linux dominant

These categories deploy millions of units globally, but are often excluded from “retail kiosk” conversations — which skews OS perception.

Field Reality / Operator Behavior

This is where experience matters.

Patterns consistently observed:

-

Windows = chosen for complex, legacy, multi-peripheral builds

-

Android = chosen for cost, speed, touch-first UI, tablet replacement

-

Linux = chosen for appliance stability, scale, and unattended use

-

Chrome OS = chosen for browser-only, IT-managed environments

How the numbers are actually calculated (simplified)

For each vertical:

-

Start with estimated installed base units

-

Apply OS weighting based on:

-

OEM default platforms

-

New shipment trends

-

Legacy replacement cycles

-

-

Normalize across all verticals

-

Sanity-check against:

-

Shipment growth direction

-

Regional deployment patterns

-

Known platform sunsets (e.g., Windows 7 retirement)

-

This produces ranges, not false precision.

Why We present ranges, not single percentages

You’ll notice we say:

-

Windows 45–55%

-

Android 25–35%

-

Linux 15–20%

-

Chrome OS 3–5%

That’s deliberate and defensible because:

-

Installed base ≠ new shipments

-

Regional mixes vary dramatically

-

Vertical mix matters more than OS marketing

Anyone claiming “Android is exactly 38.2% of kiosks” is guessing.

“Because kiosk operating systems are not tracked as a standalone metric, OS share estimates are derived from a combination of kiosk, POS, digital signage, EV, and infrastructure deployment data, along with OEM platform disclosures and observed deployment patterns across major verticals.”

Revenue share diverges sharply from unit share

The core reason:

Windows kiosks are much more expensive per unit than Android or Linux kiosks.

That single fact reshapes the revenue picture.

| OS | Typical Hardware Profile | Avg Selling Price (ASP) |

|---|---|---|

| Windows | Full PC, x86 CPU, multiple peripherals | $7k–$15k+ |

| Android | Tablet / SoC / ARM-based | $1.5k–$5k |

| Linux | Appliance / controller-based | $3k–$8k |

| Chrome OS | Thin client / browser terminal | $2k–$4k |

Estimated global kiosk OS share — units vs revenue

Installed Base (Units – recap)

-

Windows: ~45–55%

-

Android: ~25–35%

-

Linux: ~15–20%

-

Chrome OS: ~3–5%

Revenue Share (Hardware Sales) – Best Estimate

This is where it flips.

-

Windows: 60–70% of kiosk hardware revenue

-

Android: 15–25%

-

Linux: 10–15%

-

Chrome OS: 2–5%

Even as Windows loses unit share, it still dominates dollars.

Why Windows still captures the majority of revenue

A. High-peripheral density

Windows kiosks typically include:

-

EMV payment terminals

-

Receipt printers

-

Barcode scanners

-

Cameras / biometrics

-

Cash handling (in some regions)

Each adds margin.

Vertical concentration in high-ASP segments

Windows is strongest in:

-

Government / DMV

-

Healthcare

-

Transportation ticketing

-

Large-format QSR kiosks

-

Casino / gaming kiosks

These are not $2,000 tablets.

Longer refresh cycles = larger refresh projects

When Windows fleets refresh, they tend to:

-

Replace entire enclosures

-

Upgrade peripherals

-

Buy multi-year service contracts

That inflates revenue per deal.

Android dominates unit growth, not revenue

Android’s strengths:

-

Fast deployment

-

Lower BOM

-

Easier UI iteration

-

ARM efficiency

But that means:

-

Smaller enclosures

-

Fewer peripherals

-

Lower services attach

So Android may ship more new units, but still trail badly in revenue.

Linux: high unit counts, mid-tier revenue

Linux is interesting:

-

Huge unit counts in:

-

EV chargers

-

Parking

-

Transit

-

Vending controllers

-

But:

-

Many are embedded controllers

-

ASPs are moderate

-

Often purchased at infrastructure scale with tight margins

So Linux’s unit share > revenue share.

Chrome OS: niche on both axes

Chrome OS kiosks:

-

Low ASP

-

Limited peripherals

-

Narrow vertical focus

So it stays small in both units and revenue.

“The kiosk OS conversation looks very different depending on whether you measure units or dollars. Android is winning the shipment race, Linux powers massive infrastructure deployments, but Windows still controls the majority of kiosk hardware revenue because it dominates high-ASP, high-peripheral deployments.”

Revenue + Units + Service Overlay

UNITS (Volume)

Android ────────────────┐

Windows ────────────┐ │

Linux ──────────┐ │ │

Chrome OS ──┐ │ │ │

↓ ↓ ↓ ↓

HARDWARE REVENUE (ASP)

Windows ────────────────────┐

Android ───────────┐ │

Linux ─────────┐ │ │

Chrome OS ──┐ │ │ │

↓ ↓ ↓ ↓

SERVICES & WARRANTY (Lifecycle)

Windows ──────────────────────────┐

Android ───────┐ │

Linux ─────┐ │ │

Chrome OS ─┐ │ │