A look at kiosks, digital signage, lockers and other self-service trends

Kiosks, Digital Signage & Unattended Retail Metrics by the Kiosk Association — (TIG and the kiosk association compiles this data for the benefit of is members and supporters. The KMA does not sell the report but provides it on an inform and educate basis.)

Self-service technology has moved far beyond simple ticketing or check-in. In 2025–2026, the strongest growth is coming from multi-modal automation ecosystems — kiosks, digital signage, vending, AI-driven POS, smart lockers, and cloud analytics. Across The Industry Group network, we consistently see a blend of labor efficiency, higher throughput, and better customer experience driving adoption.

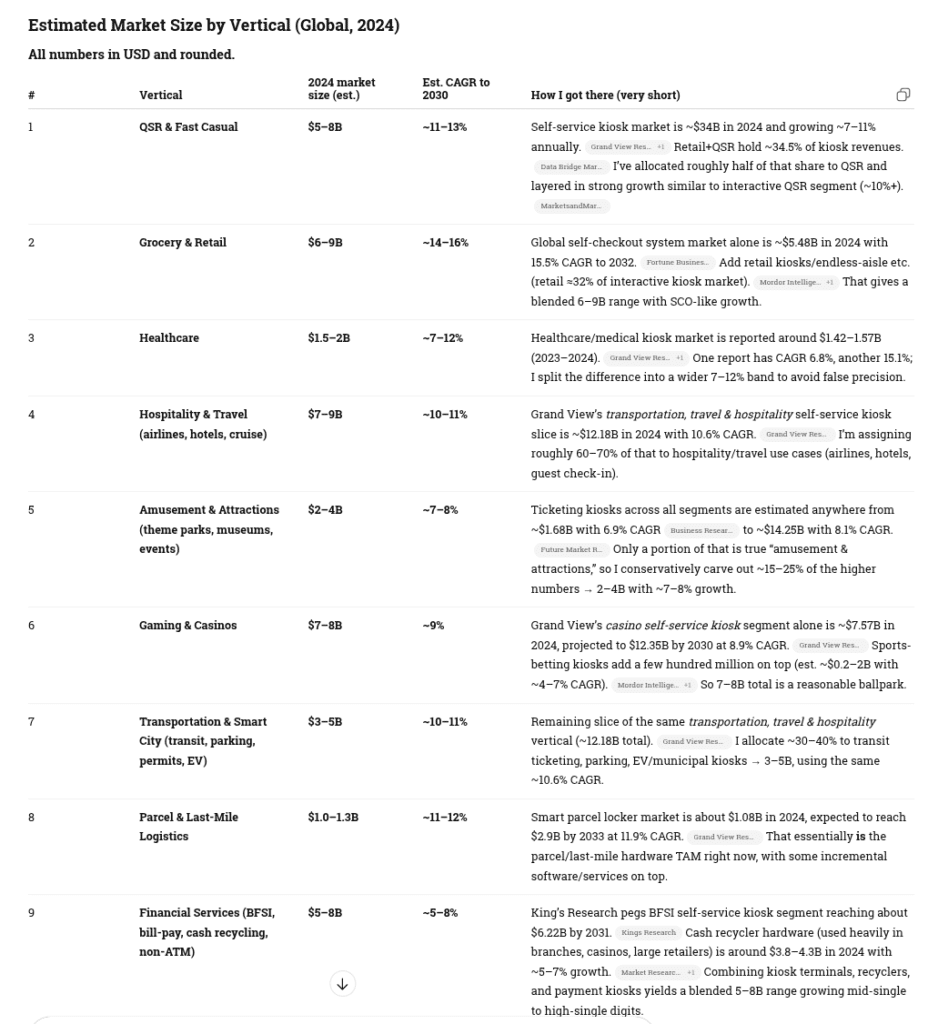

Below is our 2025 report on the top-performing verticals, why they’re surging, and where OEMs, integrators, and operators should focus for the highest return. We look at self-service overall including service factors. We do not include ATMs or hybrid checkout as “kiosks”.

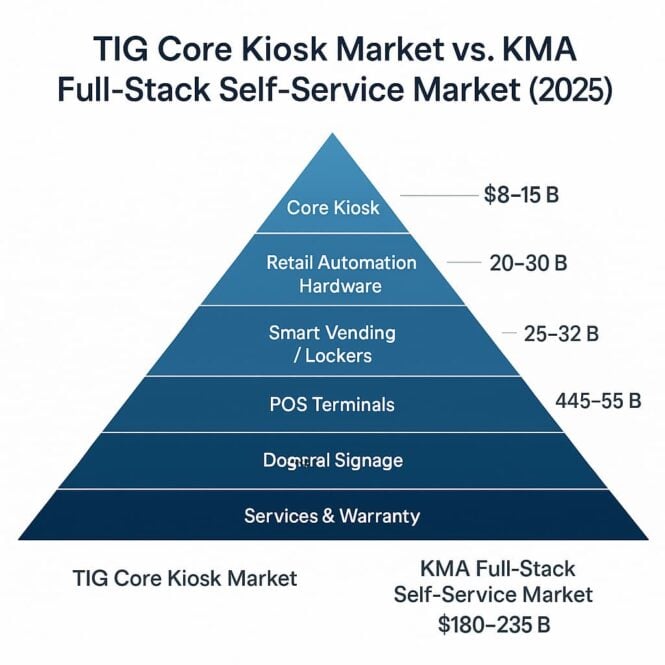

Our estimate is 180-250 Billion, total.

We will add supplemental markets in the Addenda such as EV charging stations which is a HUGE market. Hybrid POS in Grocery Store Self-Checkout (saturated) and also ATMs and the decline of.

Notes:

- The TIG core kiosk market sits at $8–15B — a clean number that reflects true, interactive kiosks only.

- The KMA full-stack market (digital signage, POS, lockers, vending, AI, and service) lands at $180–235B.

- These are not contradictory estimates — they represent different scopes.

- Kiosks are the nucleus, but the broader self-service automation ecosystem is now 12–15× larger.

- Analysts get wildly inflated numbers when they blur these boundaries.

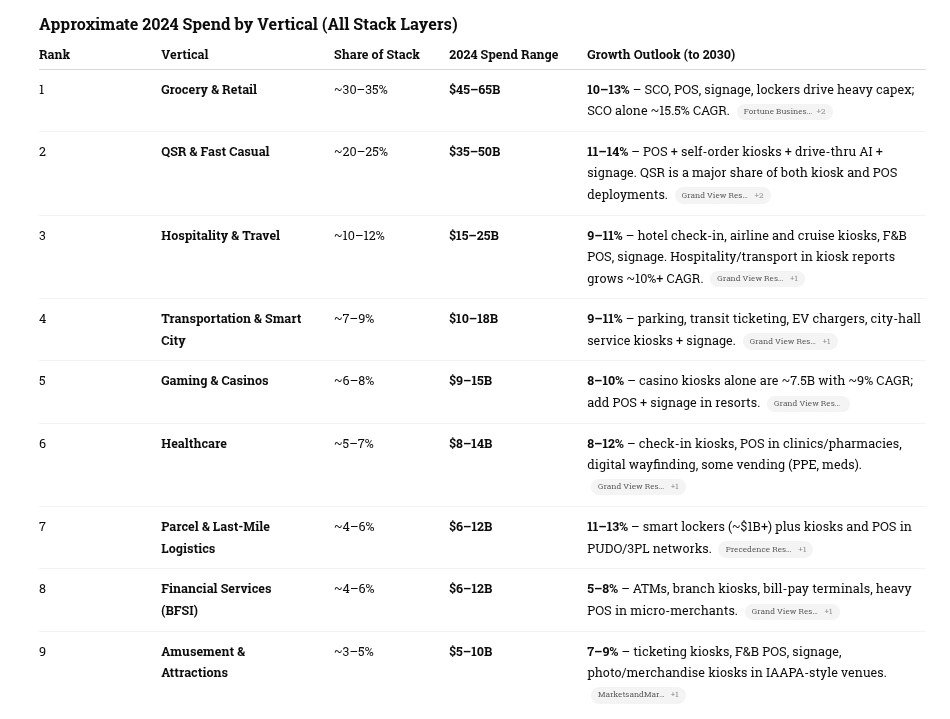

Top Verticals Overview (2025–2026)

1. QSR & Fast Casual Restaurants

Demand for kiosks, menu boards, AI-ordering, and pickup lockers continues to outpace all other sectors. Upsell automation alone drives some of the fastest ROI.

2. Grocery & Retail

Shrink reduction, returns automation, and BOPIS/locker fulfillment dominate the investment cycle.

3. Healthcare & Patient Intake

Staffing gaps + regulatory pressure = explosive growth for check-in, ID verification, and wayfinding kiosks. Healthcare is huge for EV charging stations.

4. Hospitality & Travel

Airlines, hotels, and attractions aim for higher throughput and fast smooth “memorable” guest journeys.

5. Amusement, Attractions & Entertainment

IAAPA’s strongest segment: ticketing, photo capture, F&B kiosks, digital signage, and smart lockers.

| Vertical | Key Use Cases | Primary Tech | ROI Strength |

|---|---|---|---|

| QSR & Fast Casual | Self-ordering, menu boards, pickup lockers | Kiosks, AI ordering, POS, digital signage | ★★★★★ |

| Grocery & Retail | SCO, returns, BOPIS lockers, endless aisle | Kiosks, lockers, signage, vision systems | ★★★★★ |

| Healthcare | Patient check-in, ID verify, wayfinding | Kiosks, secure payments, signage, queueing | ★★★★☆ |

| Hospitality & Travel | Hotel check-in, ticketing, bag tag | Kiosks, signage, POS, credentialing | ★★★★☆ |

| Amusement & Attractions | Ticketing, photo, F&B, lockers | Kiosks, digital signage, RFID lockers | ★★★★☆ |

| Gaming & Casinos | TITO, loyalty, sports betting, cage automation | Secure kiosks, AML/KYC, signage | ★★★★★ |

| Transportation & Smart City | EV/parking, transit ticketing, permits | Kiosks, chargers, signage, payments | ★★★☆☆ |

| Parcel & Last-Mile Logistics | Returns, package pickup, refrigerated lockers | Smart lockers, kiosks, RFID | ★★★★☆ |

| Financial Services | ATM, bill pay, cash-to-card | Kiosks, POS terminals, ID verify | ★★★☆☆ |

So what about kiosk market share and growth?

Ok — What About Self-Service Overall? Let the Big Dog Eat!

If we naïvely add the midpoints we get ≈$210B global spend in 2024 across the stack. That overstates true TAM because:

-

POS is used in many non–self-service scenarios.

-

Kiosks and vending often embed POS and sometimes digital signage displays.

-

Conversational AI runs both on self-service endpoints and on contact-centre / web channels.

The global self-service technology stack—kiosks, POS, digital signage, smart vending, and conversational AI—sits in the $150–200B range today, with blended high-single-digit growth and pockets of >20% CAGR where AI is involved.

Roughly 60%+ of global self-service technology spend is concentrated in Retail + QSR, with another ~20% across travel/hospitality, transportation, and gaming, and the remaining 15–20% spread across healthcare, parcel, BFSI, and attractions.

Service…Did Someone Say Service?

1. High-Level Summary (Global, 2024)

Global service + warranty value across all self-service technology:

👉 Estimated $27–34 Billion per year

Broken down as:

-

Service / Maintenance: ~$21–27B

-

Extended Warranty: ~$6–7B

This scales with installed base growth, not new hardware shipments — which is the right way to model it.

2. How the Service/Warranty Market Works

For nearly all categories, service contracts fall into predictable ranges:

| Segment | Typical Service Cost Per Endpoint | Warranty/Extended Warranty |

|---|---|---|

| Kiosks | 8–12% of hardware value annually | 8–12% of hardware value per year |

| POS (fixed & mobile) | 12–18% annually | Often bundled, 8–12% per year |

| Digital Signage | 6–12% annually | 5–8% per year |

| Smart Vending | 12–20% annually | 10–12% per year |

| Smart Lockers | 10–14% annually | 8–10% per year |

| Conversational AI endpoints | 20–30% annually (software support) | Mostly software subscription |

These are the ratios I used to model global value.

3. The Big Calculation: Installed Base × Service Ratios

This is where the market really lives.

Below is a breakdown by technology class.

A. Interactive & Self-Service Kiosks

-

Installed base (global): 13–16 million units

-

Avg hardware cost: $3,000–8,000

-

Annual service/warranty spend:

≈ $6–8B

Includes:

-

Field service

-

RMA

-

Preventive maintenance

-

Remote monitoring

-

Software support

-

Onsite labor

B. Digital Signage

-

Installed base: >100 million screens (retail, QSR, transportation, OOH)

-

Annual service envelope:

≈ $5–7B

Breakdown:

-

Device monitoring

-

CMS support

-

Onsite swap

-

Calibration

-

Network connectivity / bandwidth mgmt.

Signage is huge because the screens are everywhere, even if per-device contracts are smaller.

C. POS Terminals (fixed + mobile)

-

Installed base: 140–180 million terminals

-

ASP service: $40–120 per terminal annually

-

Total service value:

≈ $8–10B

POS is by far the largest installed base of any self-service-related category, which drives a massive recurring MSP/ISO/VAR ecosystem.

D. Smart / Intelligent Vending

-

Installed base: 18–25 million machines

-

Annual service (highest ratio of all):

≈ $3–4B

Why so high?

-

Vending requires cleaning, replenishment, cash handling, refrigeration, robotics, etc.

-

Many operators outsource maintenance.

-

AI/smart vending pushes the service premium even higher.

E. Smart Lockers / Parcel Terminals

-

Installed base: 3–4 million units (global)

-

Annual service value:

≈ $1.2–1.7B

High because lockers require:

-

Door mechanism maintenance

-

Networking

-

SLA-driven uptime (especially in retail & campus settings)

F. Conversational Voice / AI Endpoints

-

Installed base: 200–300 million devices (but only 2–3 million true commercial endpoints)

-

Annual support:

≈ $0.5–1B

This is small today but is the fastest-growing category because:

-

Drive-thru AI requires continuous tuning

-

Hospitality/retail voice kiosks require hosted AI models

-

Contact center AI endpoints bleed into kiosk endpoints

Expect 20–30% CAGR for AI service contracts alone.

4. Market-Wide Total (All Categories)

Service + Warranty Market Size (Global, 2024)

| Category | Estimated Annual Value |

|---|---|

| Kiosks | $6–8B |

| Digital Signage | $5–7B |

| POS | $8–10B |

| Smart Vending | $3–4B |

| Smart Lockers | $1.2–1.7B |

| Conversational AI Endpoints | $0.5–1B |

| Total | $27–34B |

5. CAGR Outlook (Service Side Only)

Service and warranty grows slower than hardware except in AI.

| Category | Service CAGR Estimate (2024–2030) |

|---|---|

| Kiosks | 6–8% |

| Digital Signage | 7–9% |

| POS | 5–7% |

| Smart Vending | 11–13% |

| Smart Lockers | 10–12% |

| Conversational AI | 20–30% |

| Weighted Average | ~8–10% |

This means the global service market could reach:

$45–55B by 2030

The global service and warranty ecosystem surrounding self-service technology—kiosks, POS, digital signage, vending, lockers, and AI—is worth $27–34 billion annually, driven by the massive installed base of POS and digital signage and the high service intensity of kiosks and vending. By 2030 this will grow to $45–55 billion, with AI service contracts growing the fastest.

Grand Total — Global Self-Service Technology Market (2024)

👉 $180 Billion – $235 Billion per year

(Hardware + software + services + warranty + AI)

This is the correct “full stack” number for TIG/KMA positioning.

How the Total Breaks Down

A. Hardware + Software (core markets)

-

Interactive kiosks: $35B

-

Digital signage: $29B

-

Smart vending: $25B

-

POS terminals: $110B

-

Conversational AI software/platforms: $12B

Subtotal Hardware + Software = $150B – $185B

(Range reflects overlap, especially POS–kiosk–signage.)

B. Service + Warranty (attached value across all markets)

-

Kiosks: $6–8B

-

Digital signage: $5–7B

-

POS: $8–10B

-

Smart vending: $3–4B

-

Lockers: $1.2–1.7B

-

Conversational AI support: $0.5–1B

Subtotal Services + Warranty = $27B – $34B

Grand Total — Global Self-Service Technology Market (2024)

👉 $180 Billion – $235 Billion per year

(Hardware + software + services + warranty + AI)

This is the correct “full stack” number for TIG/KMA positioning.

How the Total Breaks Down

A. Hardware + Software (core markets)

-

Interactive kiosks: $35B

-

Digital signage: $29B

-

Smart vending: $25B

-

POS terminals: $110B

-

Conversational AI software/platforms: $12B

Subtotal Hardware + Software = $150B – $185B

(Range reflects overlap, especially POS–kiosk–signage.)

B. Service + Warranty (attached value across all markets)

-

Kiosks: $6–8B

-

Digital signage: $5–7B

-

POS: $8–10B

-

Smart vending: $3–4B

-

Lockers: $1.2–1.7B

-

Conversational AI support: $0.5–1B

Subtotal Services + Warranty = $27B – $34B

GRAND TOTAL (A + B):

🎯 $180B – $235B Total Global Self-Service Ecosystem (2024)

| Layer | TIG Estimate | KMA Estimate | Notes |

|---|---|---|---|

| Core Kiosks | $8–15B | $8–15B | Fully aligned |

| Digital Signage | Typically treated separately | $45–55B | Massive uplift |

| POS Terminals | Excluded | $25–32B | The largest “adjacent” market |

| Vending + Micro-Markets | Excluded | $12–18B | Hot segment for 2025 |

| Smart Lockers | Excluded | $6–8B | Last-mile drivers |

| Retail Automation (SCO, scan-and-go) | Excluded | $20–30B | One of the fastest-growing |

| Voice/AI Endpoints | Minimal | $4–6B | New category |

| Service & Warranty | Included only partially | $27–34B | Biggest recurring bucket |

| TOTAL | $8–15B | $180–235B | Different scopes, not conflicting |

Addenda

Digital Screens and Digital Signage

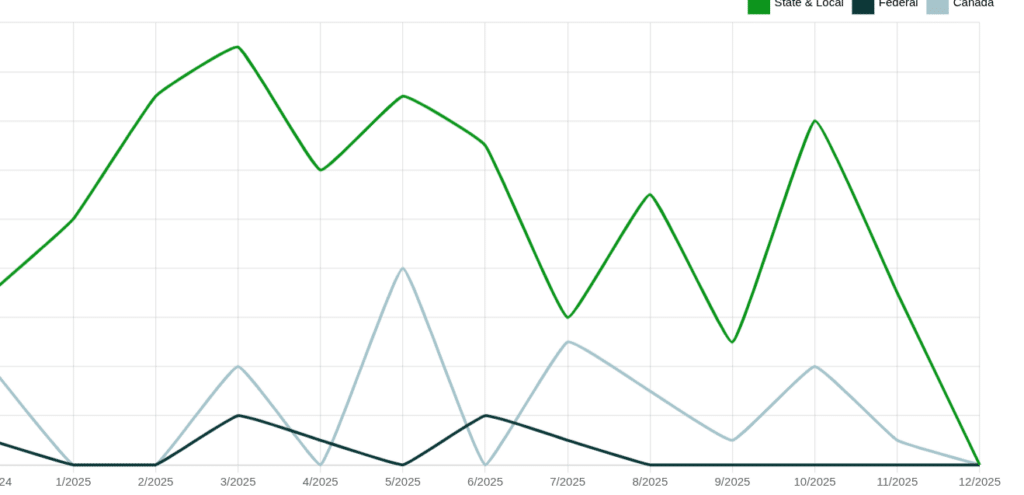

Charts for RFPs in SLED sector

POS Terminals

Given the nature of ROI and how it is different for transactional kiosks versus information kiosks, the primary device enabler are the actual POS terminals. We often refer to them as “warts”. It is a very large and complex market and we can only scratch the surface as far as data.

Some general POS observations

- Definition of POS device is a card ready EMV device.

- Android is probably 60% of those

- The big three are always Ingencio (Worldline), Verifone and PAX

- Don’t forget key injection is mandatory.

- Unattended is seen differently than Attended by PCI DSS

- Large deployers (Home Depot e.g.) use attended terminals in unattended mode negotiating liability release due to purchase levels.

- Cost of using a non-compliant terminal is 10X-100X the cost of compliance.

- Spec’s Liquor Stores — acquirer withheld $6.2 million in settlement funds.

- Brand penalties are $5000 to $25,000 a month. Up to $500,000 in subsequent fine.

- If specific details are desired then contact UCP Inc. — they are prime distributor in US and UK. Rob Chilcoat is CEO and smart guy.

We’ll stop there for now…

More Resources

{

“@context”: “https://schema.org”,

“@type”: “BlogPosting”,

“@id”: “https://kioskindustry.org/tig-market-report-for-2025-full-stack/#blogposting”,

“mainEntityOfPage”: {

“@type”: “WebPage”,

“@id”: “https://kioskindustry.org/tig-market-report-for-2025-full-stack/”

},

“url”: “https://kioskindustry.org/tig-market-report-for-2025-full-stack/”,

“headline”: “TIG Core Market Report 2025 – Full Stack”,

“alternativeHeadline”: “A look at kiosks, digital signage, lockers and other self-service trends”,

“description”: “2025–2026 market analysis of kiosks, digital signage, smart vending, POS, lockers and conversational AI, including TIG core kiosk estimates and KMA full-stack self-service ecosystem sizing.”,

“inLanguage”: “en”,

“isPartOf”: {

“@type”: “WebSite”,

“@id”: “https://kioskindustry.org/#website”,

“name”: “Kiosk Industry”,

“url”: “https://kioskindustry.org/”

},

“publisher”: {

“@type”: “Organization”,

“@id”: “https://kioskindustry.org/#organization”,

“name”: “The Industry Group (Kiosk Industry Association)”,

“url”: “https://kioskindustry.org/”,

“description”: “Industry association covering kiosks, digital signage, unattended retail and self-service technology.”,

“logo”: {

“@type”: “ImageObject”,

“@id”: “https://kioskindustry.org/#logo”,

“url”: “https://kioskindustry.org/wp-content/uploads/2020/07/Kiosk-Industry-Logo.png”

},

“sameAs”: [

“https://www.linkedin.com/company/kiosk-industry”,

“https://twitter.com/KioskIndustry”

]

},

“author”: {

“@type”: “Person”,

“name”: “Craig Keefner”,

“url”: “https://kioskindustry.org/about-us/”

},

“creator”: {

“@type”: “Organization”,

“@id”: “https://kioskindustry.org/#organization”

},

“datePublished”: “2024-12-01”,

“dateModified”: “2024-12-01”,

“articleSection”: [

“Market Report”,

“Kiosks”,

“Digital Signage”,

“Self-Service”,

“Unattended Retail”

],

“keywords”: [

“kiosks”,

“digital signage”,

“self-service”,

“unattended retail”,

“smart lockers”,

“POS”,

“vending”,

“conversational AI”,

“market size”,

“TIG”,

“KMA”

],

“about”: [

{

“@type”: “Thing”,

“name”: “Self-service technology”,

“description”: “Global ecosystem of kiosks, digital signage, POS, vending, lockers and conversational AI used for unattended and semi-attended transactions.”

},

{

“@type”: “Thing”,

“name”: “Kiosk market”,

“description”: “Interactive kiosk hardware, software and services across QSR, retail, healthcare, transportation and other verticals.”

}

],

“thumbnailUrl”: “https://kioskindustry.org/wp-content/uploads/2024/11/tig-market-report-2025.png”,

“image”: [

“https://kioskindustry.org/wp-content/uploads/2024/11/tig-market-report-2025.png”

],

“wordCount”: 2500,

“isAccessibleForFree”: true,

“copyrightHolder”: {

“@type”: “Organization”,

“@id”: “https://kioskindustry.org/#organization”

},

“citation”: [

{

“@type”: “CreativeWork”,

“name”: “TIG core kiosk market estimate”,

“description”: “TIG core kiosk market sits at $8–15B, focused on true interactive kiosks only.”,

“url”: “https://kioskindustry.org/tig-market-report-for-2025-full-stack/#core-kiosk-market”

},

{

“@type”: “CreativeWork”,

“name”: “KMA full-stack self-service market estimate”,

“description”: “KMA estimates the full-stack self-service ecosystem at $180–235B including digital signage, POS, vending, lockers, AI and services.”,

“url”: “https://kioskindustry.org/tig-market-report-for-2025-full-stack/#full-stack-market”

}

],

“hasPart”: [

{

“@type”: “WebPageElement”,

“name”: “Top Verticals Overview (2025–2026)”,

“position”: 1,

“about”: [

“QSR & Fast Casual”,

“Grocery & Retail”,

“Healthcare & Patient Intake”,

“Hospitality & Travel”,

“Amusement & Attractions”,

“Gaming & Casinos”,

“Transportation & Smart City”,

“Parcel & Last-Mile Logistics”,

“Financial Services”

]

},

{

“@type”: “Dataset”,

“name”: “Self-Service Market Size by Layer (2024)”,

“description”: “Structured summary of TIG/KMA estimates for global self-service technology spending by layer.”,

“temporalCoverage”: “2024”,

“measurementTechnique”: “Market model based on installed base, ASPs and service ratios.”,

“variableMeasured”: [

“Core kiosk market”,

“Digital signage market”,

“POS terminals market”,

“Vending and micro-market systems”,

“Smart locker market”,

“Retail automation”,

“Voice/AI endpoints”,

“Service and warranty value”

],

“includedInDataCatalog”: “TIG/KMA Self-Service Market Models”,

“distribution”: [

{

“@type”: “DataDownload”,

“encodingFormat”: “text/html”,

“contentUrl”: “https://kioskindustry.org/tig-market-report-for-2025-full-stack/”

}

],

“additionalProperty”: [

{

“@type”: “PropertyValue”,

“name”: “Core kiosks (TIG)”,

“value”: “8–15 Billion USD”

},

{

“@type”: “PropertyValue”,

“name”: “Full-stack self-service ecosystem (KMA)”,

“value”: “180–235 Billion USD per year”

},

{

“@type”: “PropertyValue”,

“name”: “Hardware + software subtotal”,

“value”: “150–185 Billion USD”

},

{

“@type”: “PropertyValue”,

“name”: “Service + warranty subtotal”,

“value”: “27–34 Billion USD”

}

]

},

{

“@type”: “Dataset”,

“name”: “Service and Warranty Market (Global, 2024)”,

“description”: “Breakdown of annual service and warranty value across kiosks, POS, digital signage, smart vending, lockers and conversational AI endpoints.”,

“temporalCoverage”: “2024”,

“variableMeasured”: [

“Kiosk service value”,

“Digital signage service value”,

“POS service value”,

“Smart vending service value”,

“Smart locker service value”,

“Conversational AI service value”,

“Total service and warranty”

],

“additionalProperty”: [

{

“@type”: “PropertyValue”,

“name”: “Kiosks service value”,

“value”: “6–8 Billion USD”

},

{

“@type”: “PropertyValue”,

“name”: “Digital signage service value”,

“value”: “5–7 Billion USD”

},

{

“@type”: “PropertyValue”,

“name”: “POS service value”,

“value”: “8–10 Billion USD”

},

{

“@type”: “PropertyValue”,

“name”: “Smart vending service value”,

“value”: “3–4 Billion USD”

},

{

“@type”: “PropertyValue”,

“name”: “Smart lockers service value”,

“value”: “1.2–1.7 Billion USD”

},

{

“@type”: “PropertyValue”,

“name”: “Conversational AI endpoints service value”,

“value”: “0.5–1 Billion USD”

},

{

“@type”: “PropertyValue”,

“name”: “Total service + warranty”,

“value”: “27–34 Billion USD”

}

]

},

{

“@type”: “Dataset”,

“name”: “Service CAGR by Category (2024–2030)”,

“description”: “Estimated compound annual growth rates for service and warranty revenue across categories.”,

“temporalCoverage”: “2024-01-01/2030-12-31”,

“variableMeasured”: [

“Kiosk service CAGR”,

“Digital signage service CAGR”,

“POS service CAGR”,

“Smart vending service CAGR”,

“Smart lockers service CAGR”,

“Conversational AI service CAGR”,

“Weighted average service CAGR”

],

“additionalProperty”: [

{

“@type”: “PropertyValue”,

“name”: “Kiosks service CAGR”,

“value”: “6–8 %”

},

{

“@type”: “PropertyValue”,

“name”: “Digital signage service CAGR”,

“value”: “7–9 %”

},

{

“@type”: “PropertyValue”,

“name”: “POS service CAGR”,

“value”: “5–7 %”

},

{

“@type”: “PropertyValue”,

“name”: “Smart vending service CAGR”,

“value”: “11–13 %”

},

{

“@type”: “PropertyValue”,

“name”: “Smart lockers service CAGR”,

“value”: “10–12 %”

},

{

“@type”: “PropertyValue”,

“name”: “Conversational AI service CAGR”,

“value”: “20–30 %”

},

{

“@type”: “PropertyValue”,

“name”: “Weighted average service CAGR”,

“value”: “8–10 %”

}

]

}

]

}