Last Updated on December 11, 2025 by Staff Writer

Consensus Recommendations for Feature-Rich and Cost-Effective Restaurant POS

We will eliminate the suspense here and let you know off the bat that TOAST and Aloha/NCR/whatever are not on the list. They are in our reading material for sure (thanks for the input Jordan).

Usual dollar-driven media rarely cover the small restaurant and the “smallest” restaurant. Not profitable for them. We were asked for recommendation and after looking at the data, and factoring the size of the establishment, here are our top three recommendations to consider along with honorable mentions.

With ANY point of sale system or business in general — spend the extra $30-$50 a month for a backup connection like DPL Wireless. You can text your employees if nothing else.

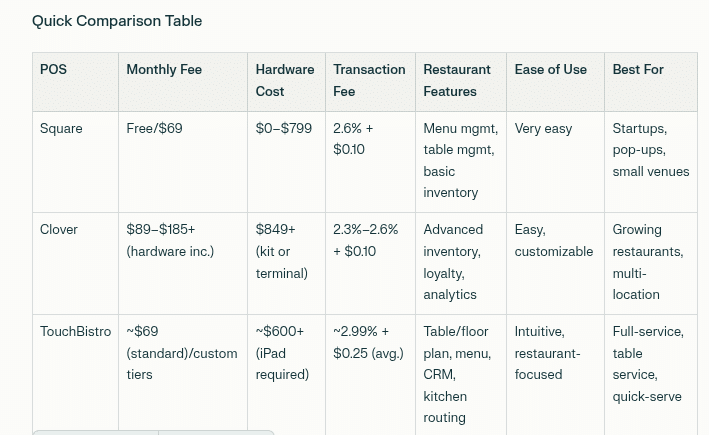

Top Three Budget Restaurant POS systems

-

Square is the most budget-friendly and suitable for small, new, or mobile restaurants (food trucks, pop-ups). Its free plan and ultra-low hardware barrier allow restaurants to start easily, although it lacks some advanced full-service features.

-

Clover shines for growing restaurants that want robust hardware (all-in-one terminals), more detailed analytics, and deeper loyalty program integrations. Its monthly fees are higher but include both software and hardware, making it ideal for teams ready to invest more for long-term flexibility. They have been increasing rates of late.

-

TouchBistro is specifically designed for restaurants and excels in table management, menu customization, CRM, and seamless coordination between front/back of house. Its iPad-based system is easy to learn and well-suited for straightforward restaurant workflows, but requires the purchase of Apple hardware separately.

- Honorable Mentions – Also Consider

- SpotOn — SpotOn’s POS rates and costs are competitive, especially for higher-volume restaurants. 2.89% + $0.25 per transaction on free plan;

- SumUp — 2.75% per swipe, no minimums, and basic reader cost is ultra-low. Best for very small businesses with sporadic sales.

Guidelines

-

Square is best for very small or single-location restaurants with limited upfront budgets. It’s easy to use and offers strong basics for food service.

-

Clover offers more features and hardware integration, but at a higher cost, making it ideal for restaurants looking to expand and add advanced reporting/loyalty tools.

-

TouchBistro is a restaurant-only solution, excelling in guest management and dining room control, but it requires iPads.

- In restaurant POS companies often focus on one vertical. An example would be FoodTec. For a pizza/delivery or multi‑unit enterprise evaluating platforms, FoodTec can punch above its overall market visibility because of its depth in those workflows and its role with chains like Marco’s.

Each system has strengths tailored for different restaurant types and growth phases. Square leads for simplicity and value, Clover for hardware and flexibility, TouchBistro for tailored restaurant experiences.

For the smallest restaurants—those processing low volumes (often less than $10,000 per month)—the best processors are typically those with no monthly fee and flat-rate pricing, as interchange-plus models often only deliver optimal savings at higher volumes.

Best Low-Volume Processors (Honorable Mention)

-

Square: Offers simple, no-monthly-fee pricing at 2.6% + $0.10–$0.15 per in-person transaction, easy setup, and no hardware requirements beyond a mobile device or tablet. Square is excellent for new or micro-restaurants due to its transparent costs and lack of commitment.

-

PayPal Zettle: Flat-rate 2.29% per swipe/tap and no monthly fee, with affordable hardware aimed at pop-ups, food trucks, and cafés.

-

Shopify POS Lite: 2.7% flat in-person rate, no monthly fee for the POS, quick setup with compatible tablets. Shopify is characterized by several in the industry as greedy.

-

SumUp: 2.75% per swipe, no minimums, and basic reader cost is ultra-low. Best for very small businesses with sporadic sales.

-

Clover Go: 2.6% + $0.10 with no monthly fee, but hardware and some features add costs as operations grow.

- Oracle Micros — actually “simphony essentials” is their bid. Complexity of setup is not in their favor. If it is a startup of three restaurants expecting to explode to 300 then a good option?

What To Know

-

These processors are optimal for operations with modest, variable, or seasonal sales and locations not needing complex hardware or advanced integrations.

-

Most small POS solutions provide free or ultra-low-cost card readers, allowing a tiny shop to get started for under $60 hardware (assuming a phone/tablet is available already).

-

Square is almost universally recommended for the smallest restaurants due to its lack of hidden fees, easy setup, and broad hardware compatibility.

Square, PayPal Zettle, Shopify POS Lite, SumUp, and Clover Go are especially popular choices for very small restaurants, food trucks, or pop-ups seeking affordable card payment processing in 2025.

Top Low-Fee Processors

-

Helcim: Interchange-plus pricing typically results in very low processor costs (0.15%–0.5% + $0.06–$0.25 above interchange per transaction), with no monthly, setup, or cancellation fees, and automatic volume discounts as business grows.

-

Stax: Wholesale interchange-plus pricing for restaurants processing over $21,000/month. Monthly fee applies, but per-transaction costs drop as volume increases.

-

Dharma Merchant Services: Extremely competitive rates for restaurants, especially those with low average tickets under $25, often among the absolute lowest transaction fees available.

-

Payment Depot: Interchange-plus pricing with very low per-transaction markups, suitable for small to mid-sized restaurants.

-

Square: No monthly fee for basic use, with 2.6% + $0.10–$0.15 per in-person transaction. Square is best for very small or new restaurants given the easy setup, though per-transaction costs can be higher for high-volume locations.

-

National and Host Merchant Services: Both offer interchange-plus pricing and month-to-month contracts, suitable for restaurants processing higher monthly volumes and looking to avoid long-term commitment and hidden fees.

Considerations

-

Restaurants with higher monthly volume (typically above $20,000) benefit most from interchange-plus processors like Helcim and Stax, often reducing transaction costs to below 2% in practice.

-

Dharma Merchant Services and Payment Depot excel for quick-service and lower-ticket eateries because of their tailored pricing models.

-

Square is ideal for startups and low-volume operations due to simplicity and no required monthly fee.

-

Host Merchant Services and National Processing often negotiate the best rates for established, higher-volume restaurants.

For the absolute lowest fees, most recommendations focus on Helcim, Stax, Dharma Merchant Services, and Payment Depot for all but the smallest restaurants.

Major POS Customers

- Chick-Fil-E — Chick-fil-A uses a custom point-of-sale (POS) system developed in partnership with software company Ditto, leveraging Ditto’s cloud-optional architecture. This system operates resiliently whether the internet connection is strong or unreliable, enabling real-time data transfer between devices and improving order speed, offline capability, and team coordination. The underlying technology is tailored specifically for Chick-fil-A’s operational needs, prioritizing reliability, flexibility, and the ability to continue transactions even during system outages.

- TOAST — lives on the cloud. Offline mode? Not really. It saves the transactions and batch uploads and syncs once connectivity resumes.

Common Offline Mode Limitations

-

No real-time multi-terminal sync.

-

Gift cards, loyalty/rewards, digital receipts, invoicing, and online ordering typically disabled.

-

Refunds, voids, or adjustments cannot be processed while offline.

-

Increased risk of declined transactions (insufficient funds) for deferred card payments.

-

Security/fraud detection not active for offline card payments until system is online.

In short, Square, TouchBistro, Shopify POS, and most leading cloud-based POS systems have similar offline constraints: core orders and cash/card payments work, but more advanced cloud-connected features do not, and there are strict limits on syncing and transaction expiration.Many popular POS systems, including Square, Shopify POS, TouchBistro, and others, have offline mode limitations like Toast: they allow basic orders and payments, but advanced features (multi-device sync, cloud reporting, loyalty, online order integration) are typically unavailable while offline.

For example:

-

Square POS offline mode allows swiped/tapped card payments and cash, but won’t process manual card entry, gift cards, invoices, or refunds; only one device can be used per transaction, and pending payments must be uploaded within 24 hours or they expire.

-

TouchBistro POS supports order-taking, closing checks, and offline credit card processing, but cloud features, loyalty, and third-party integrations won’t update; data only syncs when back online, and multi-terminal sync is offline-limited.

-

Shopify POS permits only cash and custom payments during outages; credit card payments and real-time cloud features are unavailable until connectivity is restored.

-

General cloud POS systems: Inventory, loyalty, and management features are typically unavailable or may be inaccurate until reconnected.

If seamless offline operations for all restaurant features are needed, most mainstream POS systems will encounter similar mode limitations to Toast until internet connectivity returns.

Additional Considerations

-

Recent User Feedback: We have several examples of Clover and small restaurants

-

Dealer/Support Note: Don’t forget “ease of getting support” or “quality of local dealer/installer” can be pivotal—especially for iPad-based and full-service restaurant POS like TouchBistro and Clover, where set-up and troubleshooting might be needed.

-

Integration Examples: What integrations (online ordering, delivery apps, accounting software) are well-supported or problematic with each main system? We need to add that.

-

Cloud Security: Basic security is always in play! Secure your cloud accounts and POS devices (multi-factor authentication, access roles) given the rise in cyber incidents.

Resources To Consider

- If looking at TOAST or NCR Aloha we recommend reading ReformingRetail

- Redundant network connectivity “in case”

- Wireless Modems

-

DPL — Wireless Routers & Wireless Modems for Kiosks, Micro Markets & Digital Signage — Secure. Reliable. Built to last. Designed and engineered by us, Hercules modems are known for their reliability. Backed by a 5 year warranty and protected by a solid metal enclosure, Hercules modems are designed to work in the field for 10 plus years. In a recent head-to-head field trial, Hercules modems performed 9X better than the competition. — Contact Dennis for more info — [email protected]

- Ventus — Ventus is an industry leader in IT networking innovations, leveraging technology to produce market-driving network solutions. Operating from over 20 years of experience delivering secure enterprise class networks, Ventus develops cellular wireless and fixed line SD-WAN, Hybrid WAN, and Cellular WAN solutions for an expanding array of business connectivity applications. Contact Cheryl for more info. [email protected]

Software

- Clover Kiosk POS – Restaurant ROI – 3 Examples – Kiosk Industry

- Clover POS AI Assist for Self Ordering Kiosk

- Restaurant Kiosks – latest fiserve Clover and Square kiosk

- Clover POS Self-Order Kiosk – Nanonation

- Clover Kiosk by Samsung & Nanonation

Small Restaurants

- Best Restaurant POS Systems (2025) – G2 Review

- Top 6 Best Restaurant POS Systems for 2025 – Expert Market

- 6 Best Restaurant POS Systems: Tested & Reviewed – Tech.co

- Best Restaurant POS System for Small Businesses – Waitly

- POS Systems for Small Restaurants – Square Official Site

- Best POS Systems for Small Businesses (2025) – Owner.com

- Best POS System for Small Businesses – US Chamber of Commerce

- Best POS Systems for Restaurants – Restaurant365

- 16 Best POS Software Tools for 2025 – FoodDocs

- Best Free POS Systems for 2025 – TechnologyAdvice

Restaurants

- 6 Best Restaurant POS Systems: Tested & Reviewed in 2025 – Tech.co

- Best Restaurant POS System: Square, Toast, Clover & More – Waitly

- 16 Best POS Software Tools for 2025 – FoodDocs

- 10 Best Restaurant POS Systems of 2025 – Forbes Advisor

- Best Restaurant POS Systems – business.com

- Top 6 Best Restaurant POS Systems for 2025 – Expert Market

- What are the Best POS Systems for a Restaurant? – Restaurant365

- 5 Best POS Systems for Restaurants in 2025 – Connecteam

- Best Restaurant POS Systems for US Restaurants in 2025 – GoTab

- Best POS System for Restaurants: Features & Pricing – Owner.com

- Best Restaurant POS Systems for 2025 – Peppr

- Restaurant POS 2025: SoftwareReviews – Info-Tech

- Best POS Systems (2025) | Square vs Lightspeed vs Clover vs Toast! – YouTube