Last Updated on July 6, 2025 by Staff Writer

Payment Kiosk News

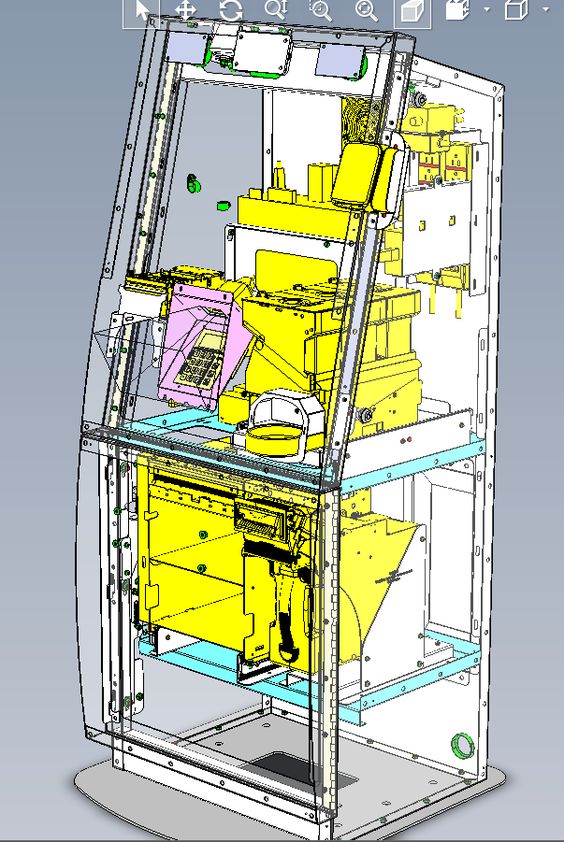

We were particularly pleased with our growth and margin performance at Payment & Merchandising Technologies,

Source: ir.craneco.com

Good financial results report for Crane, particularly with Payment & Merchandising.

Related Payment Kiosk

- Payment Kiosk – Examples and How They Work

- AT&T Bill Pay – Kiosk Industry

- Utility Bill Payment Kiosks – Cat – Kiosk Industry

About Crane

Crane Co. is a leading American manufacturer of highly engineered industrial products, with a history dating back to its founding in 1855 by Richard Teller Crane. Headquartered in Stamford, Connecticut, the company has evolved from its origins in valves and bathroom fixtures to become a global player in specialized industrial technology, serving sectors such as aerospace, defense, process industries, and municipal construction1234.

Business Structure and Segments

Crane Co. operates primarily through two major business segments:

-

Aerospace & Electronics (A&E): This segment provides advanced systems and components for commercial and military aircraft, satellites, and defense applications. In the first quarter of 2025, A&E sales grew by 10.2% to $248.9 million, driven by robust aftermarket demand and new program wins, including content for hybrid-electric military vehicles and advanced aerospace controls56.

-

Process Flow Technologies (PFT): PFT delivers engineered solutions such as valves, pumps, lined pipe, and instrumentation for industries including chemicals, water and wastewater, pharmaceuticals, and industrial automation. In Q1 2025, PFT sales increased 8.6% to $308.7 million, reflecting both organic growth and recent acquisitions, such as the expansion into abrasion- and corrosion-resistant piping for chemical and pharmaceutical customers54.

Financial Performance

Crane Co. has demonstrated strong financial momentum in recent years, especially following its 2023 strategic separation, which streamlined its focus and enhanced its investment capacity4. Key financial highlights for the first quarter of 2025 include:

-

Revenue: $557.6 million for Q1 2025, up 9.3% year-over-year, with trailing twelve-month (TTM) revenue reaching $2.18 billion, a 17.2% increase over the prior year768.

-

Earnings: Adjusted earnings per share (EPS) rose 24.1% to $1.39, while reported EPS from continuing operations was $1.34, a 31% increase from the previous year965.

-

Operating Profit: Operating profit surged by 24.4% to $101.1 million, with adjusted operating profit at $104.1 million, reflecting productivity gains and higher volumes65.

-

Order Backlog: The company’s order backlog grew 12.1% year-over-year, and core orders increased by 15.6%, indicating sustained demand and future revenue visibility69.

-

Cash Flow: Free cash flow was negative $60.4 million for the quarter, consistent with typical seasonality, but the company maintains a strong cash position with $435.1 million in cash and $247.1 million in total debt as of Q1 20256.

Strategic Focus and Outlook

Crane Co. emphasizes commercial and operational excellence, breakthrough innovation, and disciplined capital allocation. The company invests heavily in R&D and pursues acquisitions that complement its core businesses. Its management projects full-year adjusted EPS in the range of $5.30 to $5.60 for 2025, with anticipated total sales growth of approximately 5% and core sales growth of 4% to 6%5.

Recent strategic initiatives include:

-

Winning contracts for advanced aerospace and defense systems.

-

Launching new products, such as the SyFlo wastewater pump and pharmaceutical valves.

-

Continuing to shift its Process Flow Technologies portfolio toward higher-growth, less cyclical markets like water, pharmaceuticals, and industrial automation4.

Corporate Culture and Values

Crane Co. is anchored in a tradition of ethical business practices and corporate citizenship, as articulated by its founder’s resolution to conduct business with honesty and fairness. This ethos continues to shape its operations and stakeholder relationships10114.

Conclusion

Crane Co. stands out as a financially robust, innovation-driven industrial manufacturer with a clear strategic focus on high-growth, high-margin markets. Its disciplined approach to capital allocation, strong balance sheet, and commitment to operational excellence position it well for continued outperformance, even amid broader economic uncertainties546.