Last Updated on February 3, 2026 by Staff Writer

The Process of Setting Up a Field Service Offering

A practical guide for OEMs turning after-sales support into a 50%-margin growth engine.

In a previous article, I’ve outlined and elaborated on the reasons why a kiosk OEM should consider launching their own field service offerings. These entail financial benefits to the OEM, Total Cost of Ownership benefits to the Operator (OEM’s customer), and various other soft, but important, reasons. Moreover, kiosk RFPs are increasingly inviting service bids as well, presenting a disadvantage for OEMs that aren’t equipped for it.

To make a long story short, financial modeling shows that a kiosk OEM could increase their growth rate by an additional 7% year over year by launching their own field service offerings. And the margins could be between 30-50%! But best of all, this is their revenue to lose (and many are indeed foregoing this lucrative piece).

So, you’ve crunched the numbers and are salivating at the prospect of setting up your own field service offering. But you don’t know how to do it or where to start. First impressions are important, and you don’t want to tarnish your brand equity with miscalculated steps.

There are 3 phases in setting up your own service offering, and those three steps must be done in this order:

- Phase 1: Identify the commercial offering

- Phase 2: Achieve operational readiness

- Phase 3: Launch!

OK, I may have exaggerated a little. You can mix some steps in between the Phases, but generally, you must stick to starting with Phase 1 first. That is because what you determine you want to go to the market with does dictate what service operations will look like.

Each of the 3 Phases contains different items that you need to figure out. Field service offerings are not easy to setup (whether you’ll use your own service technician or work with a service partner).

Below is an overview of the work that needs to be done in the 3 Phases (blueprint for success ahead!).

Phase I: Identify the Commercial Offering

In this Phase, you are trying to:

- Identify a set of service offerings to target verticals

- Craft the value prop and design the appropriate client-facing service cycle

- Set pricing and other service contract variables

- Identify a suite of service contract partners (if needed) to subcontract work to

So where do you start? How do you determine what service offerings your clients need (or want)? It all starts with you trying to understand what the current state of service in your targets markets is, what the clients like and don’t like, and their propensity to switch.

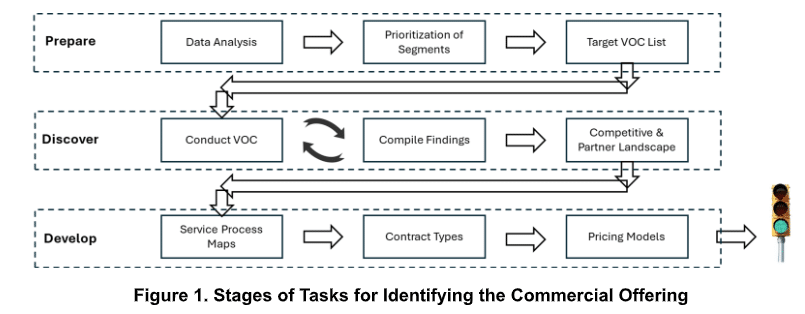

Figure 1. Stages of Tasks for Identifying the Commercial Offering

It all starts with data analysis. Which data? Your own kiosk customer data. Why? Because you will probably first offer field service for your own equipment (before deciding to expand Share of Wallet at your customer base to service other equipment; what? Is this possible? Yes!).

Start with looking at your historical sales numbers and slice and dice them by verticals and market segments. Then sit down with your Sales team and understand which Operators do not have their own field service technicians (that they therefore insist on using). Dissect those numbers in a pivot table and identify the biggest opportunities in your installed base. Then do the same for your Sales funnel. This helps you set the priorities in the target segments and select which hardware customers (your future service clients) you want to conduct Voice of Customer (VOC) interviews with.

The rest of the activities trickle from that decision. You must prepare a topics list that you want to discuss with your customers ahead of the call. It is important that you are well-prepared for the interview (as your customer’s time is precious). But more important than this readiness is your level of attentiveness during the interview. Real gems are sometimes uncovered by pursuing a thread of thought from an unexpected response during a VOC interview. VOC interviews are an art of their own and not a science. To ensure maximum attentiveness (as you will be thinking on your feet here), ensure that the individual asking the questions is not the person taking notes (yes, yes, I know AI software can listen and help take notes and action items).

Also note here that as you interview one customer after another, you should review your question list for relevance. Your question list should evolve with your learnings from one customer to the next.

And finally, craft your service offering based on customer learnings. Naturally, you may not have to wait till all VOC interviews are completed.

In crafting your service offerings, you will have to draw your client-facing service process maps (which should be better than the incumbents’), set your contract types with their parameters (SLAs, weekend service, % of SLA to be met on a monthly basis or other time period, the structure of your service contract etc. etc.). The contract parameters are very important and some of those will evolve as you acquire scars in the first year or two of launch.

Of course, appropriate pricing is needed as you will have to displace incumbents by leaving value at the table for your prospective clients.

Concluding this Phase also means that you have a good idea of what service operation “blocks” you need to put in place, and which you will do yourself organically vs achieve with a partner (for which you have developed a prospective list).

This Phase gives you your commercial blueprint: who are your target clients, what are your financial projections for this side of the business and what is the profit margin you should realistically expect. With the topline targets in place, you can now pivot to the cost side and operations.

Phase II: Achieve Operational Readiness

Now that you figured out what you want to offer to the market and how you think you can beat competition, you need to start to put the infrastructure in place to execute on your field service contracts.

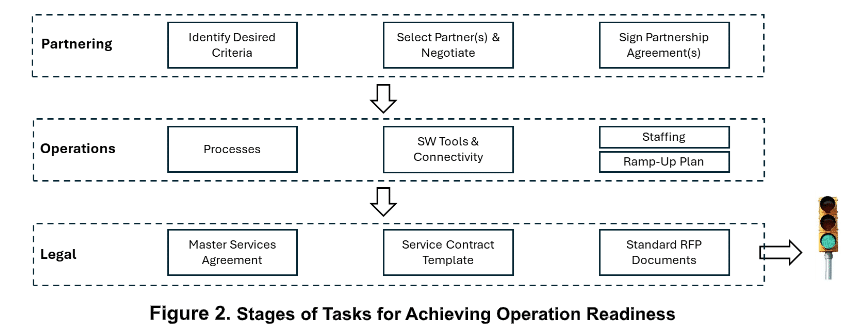

Much like the first Phase, this Phase can also be broken down to stages and steps, and that is shown in Figure 2 below.

Figure 2. Stages of Tasks for Achieving Operation Readiness

The first question you should ask yourself is: “What can or should I setup myself and what should I rely on other partners for?”. This is the most critical question because it helps you focus your energy and capital and forces you to identify your “secret sauce” that you should build and maintain in-house. I say it helps you focus on your “secret sauce” because there is a possibility that your competitive advantage in winning a service contract is NOT field service technicians. Surprised?

If you have determined that you will need to partner for some operational items, the first thing you should do is identify a list of qualifications that are a must-have and a nice-to-have in this partner. Rate your partner list (recollect you put it together in Phase I) against these qualifications, set a weight to each, score them and sort them in order of highest score to lowest. Then begin the process of reaching out to those partners and negotiate a mutually satisfactory relationship.

The above should run in conjunction with laying down infrastructure, specifically around internal service processes (that will interact with your clients as well as your partners), the software tools that you need to run a service business (these are very critical!) as well as organizational structure and staffing.

Software tools are critical to running an effective Service business. Increasingly, it is not just about opening and closing tickets, and issuing dispatches, but also about tracking KPIs and more importantly remote monitoring of equipment to avoid a dispatch altogether and speed up the equipment remediation process. An average dispatch for a kiosk will cost you about 1.5 hours of technician time. Unfortunately, many dispatches are for issues that can be remotely addressed (with proper connectivity into the machine). After being in the Service business for a while, I no longer smirk at IT when they ask their first question: “Did you reset your laptop?”.

A note about staffing. The field service business is VERY different than the hardware selling business and will in fact cast a shadow on it. In the past, you had given your hardware salespeople an Extended Warranty plan at a certain price, and they were pushing it along with the hardware sale. Now that you have officially set up annual (or longer timeframe) service contracts, burdening the hardware sales team with going out and winning service contracts isn’t likely to produce the desired results on the service side. Recollect that you were not achieving a high attach rate of Extended Warranty sales with hardware to begin with. In the end, it is a matter of economics for the hardware salesperson: make (let’s say) a 1% commission on a $10K kiosk or make 1% commission on a $1K service contract (numbers for illustrative purposes only).

In plain English, you are probably going to want to hire a dedicated (team of) Business Development staff and task them with winning service business.

And of course, let’s not forget all the paperwork needed to bid for service tenders and close the sale: those Master Services Agreements, Service Contract Templates (not the same as the former), and standard RFP documents you want to keep handy for a faster RFP response time (most RFPs generally require some background documentation around your business).

With the conclusion of this Phase, you are now ready to start your first dispatch!

Phase III: Market Launch

The moment has come!

You know what you want to offer. You are now ready to execute. Time to go to market! Let the newly hired service-focused Business Development staff go for it!

Alas, it is not that simple! You must get the Business Development team organized first and well-equipped for the task at hand.

Here is a list of things you need to put in place to enable Service sale:

- Marketing collateral (brochures, presentations, advertising, including a corner on your website dedicated to the service offering)

- Customizable ROI calculators, pricing tools etc.

- Sales training material that are used to get the Business Development team speaking the same language and selling it the way you want them to

- Separate Sales funnel, complete with stages, information to be logged in each stage, transition criteria and target dollars

When everything is in place and your Sales team is trained, it is time to turn the lights on and go for it!

In Conclusion…

Kudos to you if you have not been intimidated by the methodology outlined above to setup a field service offering. It is not easy, and it will never be perfect, so be prepared to make some mistakes and learn from them.

So, recognizing that you will probably make mistakes, it is best to start with a pilot client. My philosophy in selecting one is that it is either:

- A customer/client whom you have an excellent relationship with, understands what you’re trying to accomplish and is willing to forgive any early mistakes, OR

- A small customer/client without a large connection network in your major markets such that any disappointments that might develop because of the pilot would not be transmitted to a wide audience

And finally, I must stress again that some tasks across Phases might overlap. For example, identifying internal service processes in Phase II is intricately connected to the determination of the target client service cycles. Another example is that the Service Contract Template can be generated in the last stages of Phase I where you would have identified the contract parameters. As you kickstart the process and dive in, you’ll intuitively be able to identify what you can start ahead of time.

More Resources

- Service Offerings Kiosk OEMs: Why They Matter & How to Build Them

- KIOSK Information Systems Virtual Tour

- U.S. Kiosk Market Research Report KMA – Updated 2024

- Video of poorly installed Lay Boy kiosk with security implications – textbook HOW NOT TO

1. Industry Context & Field Service Benchmarks

These help rconnect kiosk service models to the broader field service management and aftermarket support industry:

-

Service Council — https://servicecouncil.com/

→ Research on service revenue models, technician enablement, and customer experience. -

Field Service News — https://www.fieldservicenews.com/

→ Articles and reports on digital transformation in field service (FSM software, AI dispatching, KPIs). -

Gartner FSM Market Guide (summary via TechTarget):

https://www.techtarget.com/searchmobilecomputing/tip/How-to-set-up-kiosk-mode-for-iPad-and-other-OSes

→ Explains software tools, operational readiness, and scalability considerations.

🔹 2. Kiosk Industry & OEM Service Ecosystem

These links anchor your readers in the kiosk-specific angle, showing how other manufacturers or associations handle service delivery:

-

Kiosk Manufacturer Association (KMA) — https://kma.global/

→ Compliance, ADA, and industry standards relevant to field support. -

Olea Kiosks Service Programs — https://olea.com/

→ Example of an OEM offering in-house support and maintenance plans. -

Pyramid Computer AG – Service & Support — https://www.pyramid-computer.com/en/service/

→ Demonstrates how an international kiosk OEM structures maintenance and service contracts. -

Nanonation Support Portal — https://www.nanonation.net/

→ Illustrates post-deployment software and monitoring frameworks.

🔹 3. FSM Technology Tools (Operational Readiness Section)

These fit nicely where you mention software tools and infrastructure:

-

ServiceMax — https://www.servicemax.com/

→ Industry leader in FSM platforms for OEMs. -

Salesforce Field Service — https://www.salesforce.com/products/field-service/overview/

→ Integrates CRM with service scheduling and mobile workforce management. -

Zinier — https://www.zinier.com/

→ AI-driven FSM solution emphasizing predictive maintenance and technician efficiency.

🔹 4. Customer Data & VOC Methodology

To reinforce our section on Voice of Customer (VOC) interviews and data-driven targeting:

-

Harvard Business Review: The Value of Listening to Customers — https://hbr.org/ (search “Voice of the Customer”)

-

Qualtrics VOC Program Guide — https://www.qualtrics.com/voice-of-customer/

Both are excellent resources to link where you discuss VOC planning and adapting question lists.

🔹 5. Service Economics & Attach Rate Strategy

These references expand on your service revenue and margin discussion:

-

McKinsey: The Business Value of Aftermarket Services — https://www.mckinsey.com/industries/advanced-electronics/our-insights/aftermarket-services

-

Deloitte Insights: Turning Service into Profit — https://www2.deloitte.com/ (search “Aftermarket Services Profit”)

They back up your claim that OEMs often “leave value on the table.”