Why Kiosk OEMs Should Build Field Service Offerings

I continue to be surprised as to why most kiosk OEMs in the US do not offer field services to the customers who bought and installed their kiosks. As the “factory”, it is YOUR RIGHT to earn this service revenue. Why give it away?

And no, an extended warranty is not a service contract. Well, maybe, if it extends in-field break-fix services. But many extended warranties, in the not so often times they are sold with the equipment, cover only spare part swaps or depot repairs, or require the kiosk Operator to ship the kiosk to the OEM premises for repair (imagine the cost of that!).

There are many reasons why an OEM should take on the field service aspect of their kiosk into their own hands:

- Financial benefits to the OEM

- Better Total Cost of Ownership (TCO) for the Operator

- Brand Equity protection for the OEM

- Real-life performance and quality data gathering

- Insights into challenges faced by Operator staff

- Closer ties to Operator, leading to better replacement rates and less customer churn

Financial Benefits of Offering Field Service

Depending on several factors, Service costs Operators anywhere between 7-15% of the capital cost of the kiosk every year. It escalates with inflation and the age of the kiosk. Some OEMs might find this revenue adder not interesting, or not worthwhile the effort of starting their own service operations, but they forget the two important aspects of this revenue stream:

- It is recurring, or re-occurring, every year over the lifetime of the kiosk installation, and…

- It is accumulating in nature.

Once you sign a client (your kiosk Operator) onto a service offering, and so long as your pricing is reasonable and you are meeting the Service Level Agreements (SLAs), you can rest assured the client will renew with you for years to come until the kiosk is decommissioned. In other words, you don’t have to continue “hunting” for new business and therefore don’t have to pay higher Sales commissions to earn this revenue. It provides a nice level of “base” revenue for budget planning year after year.

Better yet, the main difference between Service revenue and Hardware revenue is the cumulative nature of the former. You sell 100 kiosks, along with service agreements worth annually $1,000 per kiosk (just an example) the beginning of this year. You know you’ll be earning $100K in Service revenue this year.

Next year, let’s say you exactly replicate this year’s sale. You’d be earning the same amount of HW revenue, but now, your Service revenue has doubled to $200K (assuming you’ve kept your first kiosk batch client onboard). And on and on it goes.

Over time, and assuming flat hardware sales (for ease of math), your Service revenue builds up to be a significant percentage of hardware revenue. The steady state for Service revenue is largely a function of the lifetime of the kiosk in the field and the typical Service contract price as percentage of the price of the kiosk. If you manage to on-board clients with Service contracts at 10% of the kiosk price, and the kiosks you sell, year after year, last 7 years in the field, your Service revenue should build up to 70% of the hardware revenue. If you manage to sell Service contracts at 15% of the kiosk price, your Service revenue could build up to 1approximately 00% of the hardware revenue. In other words, you’d reach a state where service constitutes half your revenue, with reasonable predictability.

But OEMs don’t have to wait 7 years to get to this level of Service revenue. The good thing is that they already have an installed base of their own kiosks that they’re not currently servicing, so they can also target this pool of kiosks and onboard them to the service program of the “mothership”.

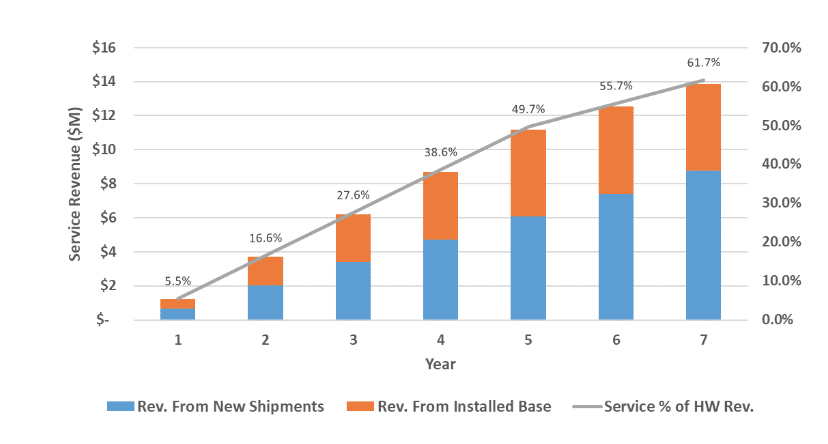

Figure 1 below shows how Service revenue can ramp up to over 60% of the HW revenue for a $25M kiosk OEM, with modest assumptions.

The above example assumes that the OEM manages to attach a service contract for only half the annual new shipments for kiosks with annual Service contract price of 12% of its capital cost of $8K. It also modestly assumes that the OEM can convert only 30% of its currently installed kiosk base to its own service offering.

Better TCO for the Operator

Total Cost of Ownership (the cost over the lifetime of the kiosk) can be one of the criteria Operators use to evaluate the different bids by OEMs before awarding their RFP. As such, it is important for the OEM that’s aspiring to win that theirs is the lowest and the most credible. But how can an OEM provide any such assurance when Service cost, which is roughly equivalent to the capital cost of the kiosk over its lifetime (if not higher), is not set (nor dictated) by them?

It is also no secret that many Operators nowadays prefer a one-stop shop where the kiosk OEM can also perform field service (or partner with another service provider to do so). The Operator’s motivation in this case is not strictly limited to simplifying their operation and dealing with one entity, but it is getting increasingly recognized that the OEM is best suited to keep the kiosk up and running and in tiptop shape. Every bit of downtime diminishes the ROI of the kiosk for the Operator, therefore increasing its TCO. Winning such opportunities (which can be usually substantial) necessitates that an OEM does not be at a disadvantage vs. another bidder that has figured out the Service piece of the equation.

Brand Equity Protection for the OEM

Do not underestimate the importance of your brand!

Operators want to invite only reputable kiosk OEMs to bid for their business. What happens with your previous kiosk installations can stain your brand even though it may not have been your fault.

Take this story for example. One Operator did not have the option of procuring field service from their kiosk OEM, so they signed up with an independent provider, and it appears to have been one of the cheaper ones (forgive them for they do not know!). But with cheap service pricing usually comes poor service. That service provider relied on a field service marketplace to source a 1099 technician in the target geography, who in turn had no training on the underlying kiosk model, nor did it seem that he cared about the quality of his work to begin with. The technician was tasked with getting into the kiosk to replace a part, in the process pulling out the pin camera that was on the kiosk. At the end of the job, that tech did not know how to reinstall the pin camera back in its place, so he simply put it, still attached to its wire, on top of the kiosk.

Now, who will the Operator staff on the ground blame for this? They may not know the name of the service provider, but they can see the logo on the kiosk. Also, what if one of the users of your kiosk in that installation happens to be in the future in a decision committee awarding a kiosk RFP on behalf of their employer?

Your reputation is not derived strictly from your timely delivery of your kiosks for installation. Your product in the field casts a continuous shadow on your brand for the whole lifetime of its operation in the field.

To stay in control of your product during its to protect the sanctity of your brand.

Real-Life Performance and Quality Data Gathering

“My kiosks are of high quality!”

Always curious (and sometimes provocative), I ask the person at the other side of the table: “How do you know this?”

“We don’t get a lot of requests for spare parts from our customers. Therefore, it does not need to be repaired often.”

“Hmm, seems like a reasonable position to take then,” I thought to myself.

Later in the conversation, when we were discussing how spare parts pricing can be strategic in positioning the service contract vs. an independent service provider, I hear this: “But it might be difficult to price spare parts to tilt the service contract economics in our favor.”

“Why?”, I asked.

“Because our customer can buy the spare parts themselves directly from our suppliers.”, was the response.

Oh, wait!

We all know the two cycles of field service and depot repair both factor into service cost. Some Operators keep their own inventory of spare parts and contract with a depot repair house that is different from the field service provider. And Operators don’t always want to pay the spare parts markup of the OEM, so they require a connection to be made by them directly to the manufacturers of the modules in the kiosk.

So how, then, can the OEM get a good handle on the quality of the kiosk if they can get disconnected from the spare parts and depot repair cycle? By being involved on the service side!

Insights into Challenges Faced by Operator Staff

In addition to quality, wouldn’t it be valuable for the OEM to know how the users of their kiosk are interacting with it? I am not necessarily talking about the field technician talking to users on the ground while they’re at the kiosk, but some repeated points of failure might indicate a need to improve the UI/UX in some area of the kiosk.

Furthermore, if Operator staff are nearby, being onsite represents a valuable opportunity for the OEM to ask the staff on the ground some valuable questions about their impressions of their kiosk, which can lead to valuable improvements of future designs.

But also consider that the ability to solicit in-person feedback from the Operator staff can lend valuable insights into the kiosk ROI and uncover value elements the Operator’s own management may not have factored in when procuring the kiosk. Specifically, how would the task automated by the kiosk be completed when the kiosk is down? Is there an alternative, and what is the cost of this alternative way of doing things? Is the alternative equally available during “rush hours” at the establishment vs the rest of the day? Many questions could be answered if you have direct access to the people on the ground.

Closer Ties to the Operator, and Better Replacement Rates

Needless to say, if you have multiple touchpoints with your customer at different levels and functions within their organization, you will increase your stickiness and better ensure their future business comes your way. When the VP of Operations at your customer organization pitches in your favor, and validates your operating cost estimates, this tilts the odds heavily in your favor for repeat business.

But let’s not lose sight of economics in the later stages of the kiosk’s life. If the OEM, who also controls spare parts, and also desirably depot repair, and quite importantly software updates, is in charge of keeping uptime, with its associated service costs, they would be in a prime position to kickstart the replacement cycle, perhaps even ahead of the originally intended 7-year lifetime. When you’re in charge of all the elements of the TCO, you’re also in prime position to convert the next tender from a CAPEX + OPEX oriented one to a fully OPEX RFP with an As-A-Service offering specifically tailored for that customer.

The above said, it might not be always obvious as to what service offerings the kiosk OEM should add and how to appropriately position and execute them. That topic warrants its own future article.

About the Author

Addendum – Questions Raised

Financial Impacts

-

How do the recurring service contract revenues compare with typical hardware sales margins for kiosk OEMs?

-

What are the operational challenges or typical costs involved in launching in-house field service programs?

Competitive Positioning and Brand

-

What are best practices for ensuring quality control when transitioning from independent service providers to OEM-led service?

-

How do field service offerings directly influence brand reputation and future RFP opportunities for kiosk OEMs?

Data and Operational Insights

-

What systems or processes can OEMs adopt to efficiently capture real-life kiosk performance and service quality data from field operations?

-

In what ways can field service feedback be integrated into product design or software updates for future kiosk models?

Customer Relationships and TCO

-

How do service contract options impact Total Cost of Ownership for the Operator, especially when compared to independent service contracts?

-

What specific questions should OEMs ask Operator staff during field visits to maximize value and improve the kiosk’s ROI?

Strategic Planning

-

What models exist for pricing service contracts (e.g., % of hardware cost, flat rates) and how are these tailored to length of kiosk lifecycle or operator needs?

-

What are some “As-A-Service” offering examples that OEMs could pilot when ready to shift focus from CAPEX-led tenders to OPEX-led tenders?

Implementation

-

What typical barriers prevent OEMs from adopting their own field service programs, and how can they be overcome?

-

How can OEMs transition existing installations (currently serviced by independent providers) into their own service programs?

Example Companies Who Would Benefit

Here are 20 companies—manufacturers, providers, and deployers of self-service kiosks—that would benefit from reading this article:

-

KIOSK Information Systems (Louisville, CO) — (already provides through partners)

-

Olea Kiosks (Cerritos, CA)

-

American Kiosks [no longer in business]

-

Kiosk Innovations

-

Meridian Kiosks (Aberdeen, NC)

-

Frank Mayer and Associates (Grafton, WI)

-

MetroClick (NYC)

-

Advanced Kiosks (Concord, NH)

-

REDYREF (Riverdale, NJ) — (already provides through partners)

-

Palmer Digital Group (Aurora, IL)

-

Zivelo LLC (Scottsdale, AZ) [no longer in business]

-

NCR Voyix Corporation (Atlanta, GA) – (already provides own techs)

-

Diebold Nixdorf – (already provides own techs)

-

Glory, Ltd. – (already provides own techs)

-

SlabbKiosks

-

Peerless-AV

-

Source Technologies (Charlotte, NC)

-

OptConnect

-

CompuStation, Inc.

-

Toast