IHL presented a webinar on the impact of COVID-19 on the overall economy and segments the hardest hit. It is recommended. One of the takeaways for us is the large opportunity for automation, HMI and kiosks in the future.

How do the US C.A.R.E.S Act stimulus programs affect retail? The answer might surprise you. Get an update on retail/hospitality and how the stimulus plans, with delays and competing priorities, will, unfortunately, hasten the demise of many retailers. Click the photo below to launch the webinar replay.

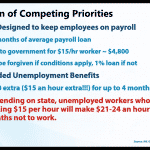

In the short term, it is going to be tough for small businesses which are basically owner-operated and under 50 million in revenue. The confluence of the minimum wage, unemployment benefits, questionable at best awards of first-round SBA loans along with a diluted environment for selling due to social distancing, once again has Small Business having to look out for itself.

Editors Note: We applaud companies such as Shack Shack which having received CARES money decided it was better utilized by struggling small businesses. We cannot say the same for companies and institutions like Ruth Chris and Harvard. We recommend resources such as the CRFB and their ongoing analysis of monies and recipients (much like 2009 stimulus).

- Presentation slide titled Concluding Summary. Key points include prolonged economic shock due to COVID-19 impact, competing stimulus plans affecting retail and small businesses, supply issues, low oil prices serving as retail stimulus, and significant technology impacts. Logo in top right corner.

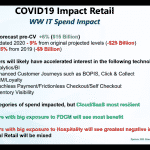

- Slide titled COVID19 Impact Retail: WW IT Spend Impact explores trends and impacts in retail IT spending, highlighting forecast changes, technology investments like analytics and cloud, and effects on different vendor categories. It also addresses the COVID-19 impact on small business dynamics in this sector.

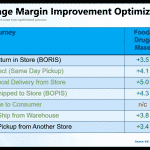

- The table titled Average Margin Improvement Optimized highlights the COVID-19 impact on small businesses, comparing margin improvements across customer journeys for Food/Drug/Mass and Dept and Specialty Stores. Each journey is listed with its respective numeric margin shifts.

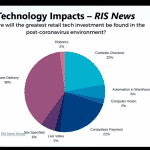

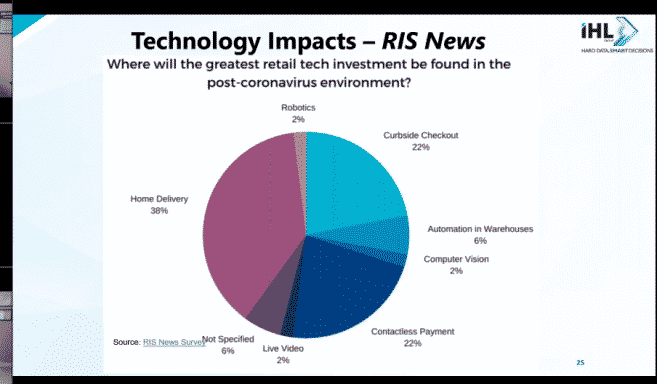

- A pie chart titled Technology Impacts – RIS News highlights expected retail tech investments post-COVID-19: Home Delivery 38%, Curbside Checkout 22%, Robotics 22%, Automation in Warehouses 6%, Computer Vision 2%. Small businesses are eyeing these innovations to adapt to new challenges.

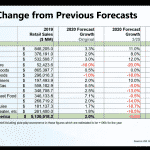

- A table comparison highlights the COVID-19 impact on North American retail sectors, detailing changes from previous forecasts. It contains columns for 2019 retail sales and forecast growth percentages for 2020, updated on 3/25 and 4/15, with revisions noted for small businesses.

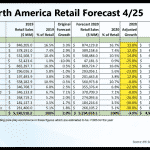

- Table titled North America Retail Forecast 4/25 highlights retail sales from 2019 to 2020 across categories such as Food/Grocery, Drug Stores, and Entertainment. With columns detailing sales in millions, growth percentages, and adjustments for 2020, it reflects the COVID-19 impact on small businesses. Source: IHL Group.

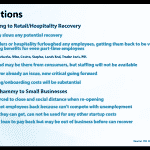

- Slide discussing COVID-19s impact on business. Points include slow recovery for retail/hospitality, turnover, staffing challenges, and hurdles for small businesses. Highlights specific stores and the difficulties faced with the Payroll Protection Program (PPP).

- Slide titled Problem of Competing Priorities examines the COVID-19 impact on small businesses, focusing on PPP payroll support and expanded unemployment benefits. It includes financial details and notes potential earnings through unemployment based on state, citing iHL Group as a source.

- Slide displaying C.A.R.E.S Act Implications for Retail with three bullet points: Economic Injury Disaster Loan (EIDL), Payroll Protection Program (PPP), and Expanded Unemployment Benefits. Highlighting the COVID-19 impact on small businesses, with logos at the top right corner.

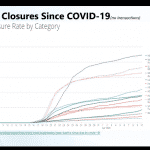

- Line graph illustrating COVID-19s impact on small business closure rates by category. Categories such as restaurants, retail, healthcare, beauty, and fitness show varying trends over time. The source is www.womply.com.

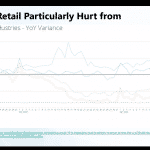

- Graph illustrating year-over-year variance for industries highlights the COVID-19 impact on small businesses. Grocery shows a +12-65% change, Retail & Services -12% to -36%, Restaurants -40% to -84%, Travel/Tourism -20% to -84%. Title: Small Retail Particularly Hurt from Top Level Industries – YoY Variance.

- Slide titled Small Business Impact highlights the COVID-19 Impact on Small Businesses, featuring data from Womply. IHL Groups logo is tucked in the top right corner, set against a light blue gradient background.

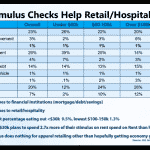

- Chart titled Will Stimulus Checks Help Retail/Hospitality? reveals how different income groups allocate them, with categories like Essentials and Home Improvement. Financial impacts on small businesses due to COVID-19 are noted alongside retail spending patterns in areas such as Clothing and Eating Out.

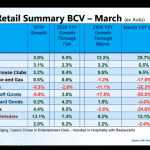

- Chart titled US Retail Summary BCV – March (ex Auto) by IHL highlights growth percentages for various retail sectors in 2019 and 2020, detailing growth through February and March. Categories like Food, Drug, and Restaurants are shown with insights on COVID-19 impact on small business growth.

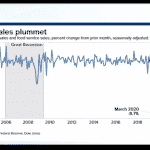

- A line graph titled Retail Sales Plummet illustrates the COVID-19 impact on retail sales, depicting a percent change from 2006 to 2020. A significant drop to -8.7% occurs in March 2020, affecting small businesses. The Great Recession is highlighted between 2008 and 2009. Source: St. Louis Federal Reserve, CNBC.

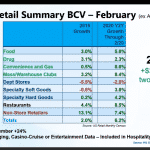

- A chart highlights the US Retail Summary BCV for February, excluding autos. It contrasts 2019 growth with a +6.4% improvement in early 2020 despite the looming COVID-19 impact on small businesses. Categories like food, drugs, and specialty stores propelled a modest +2.0% growth in 2019.