Last Updated on December 7, 2025 by Staff Writer

New opportunities continue to alter the kiosk industry landscape.

By Laura Miller, Marketing Director KioWare

Reprinted with permission from Kiosk Solutions magazine Issue #1.

Introduction

Interactive kiosks are not a new concept. In fact, companies have been deploying them for more than 35 years. Kiosks have long been a tool used primarily by large organisations with multiple locations, large staffs and extensive budgets. As technology has evolved, new markets and opportunities continue to emerge, creating a broader definition of what a kiosk looks like, what it can do and who it can help. This evolution varies by geographic location and mature markets look significantly different when compared to nascent markets.

Affordability

Like many nascent technological tools from this generation, kiosks have seen a complete re-imagining from their original form. The changes that have occurred have shifted the landscape of the kiosk industry significantly. Like much of the technology of the past 50 years, kiosks continue to become less expensive and more accessible, appealing to a broader group of organisations and potential deployers.

Kiosks are built using computing devices. Those computing devices have significantly dropped in price since their inception, with initial costs exceeding £5,200 and sizes that required large metal enclosures to protect from theft or damage. Those enclosures could also be costly and difficult to build. Add on the cost of developing a custom software application or a custom website, plus software to secure that application or website (now known as kiosk software), and the initial cost of one kiosk was quite prohibitive for most organisations.

Scalability

Even as an emerging technology, scalability made traditional kiosks more cost effective. Once an enclosure was designed, building additional enclosures to the same specifications became less expensive. Similarly, the computer hardware and kiosk software became less expensive when purchased in

quantity. More significantly, once an application was developed, the cost of that was negligible and benefited significantly by scaling.

Large corporations with multiple locations were able to leverage this scalability and deploy kiosks to improve customer experiences, increase sales, create brand awareness, decrease wait times and optimize staffing. Medium and small businesses continued to see little opportunity to utilize kiosks in a cost effective and affordable manner.

Accessibility

Then things changed. With the evolution of the computer and the creation of the tablet, both PCs and mobile devices have become more affordable to purchase and easier to enclose. As a result in the decreased size of PCs, the creation of the touch screen and the invention of the tablet, enclosure sizes can be reduced and at a lower cost. Out of the box enclosures can be purchased as a single unit or in cost saving quantities, without paying for a custom solution.

Software has also become more accessible as every business has the opportunity to create a website using an out-of-the-box content management system, easy to create online stores and low cost application development. Leveraging existing collateral, businesses can easily and inexpensively deploy one or multiple kiosks for a fraction of the cost of early kiosks.

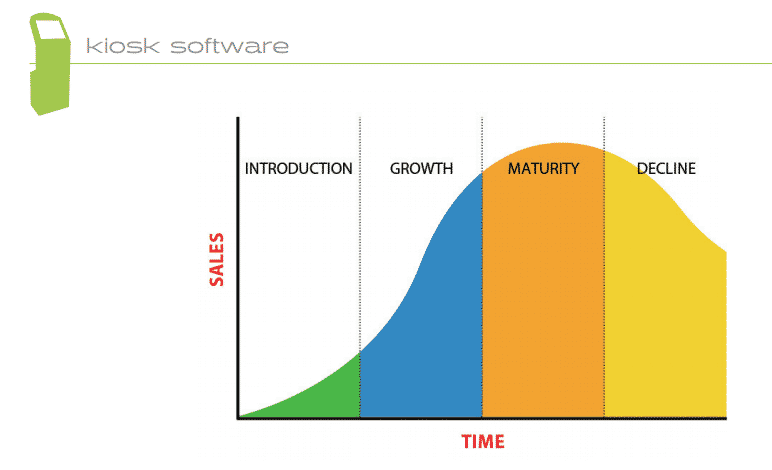

If, as one might expect, larger organisations are a mature kiosk market (see ‘maturity’ in the above diagram) particularly in developed economies, the potential growth of that area is limited. Fortunately for the UK, in particular, there is an as yet untapped market for kiosk growth. Small and medium sized businesses make up 99.9 per cent of the UK’s private sector.

In particular, small business, sized at 49 employees or less, comprise 99.3 per cent of all private sector business in the UK.

The increased accessibility of kiosks benefits these small and medium-sized companies the most, allowing them to gain access to the technology without paying premium costs. Robust systems with external devices for payment processing can be purchased, configured and deployed for only a fraction of

previous prices, opening the door for those who need one or two devices to take advantage of the technology. The fact that the majority of small and mediumsized businesses now operate their own websites mean that an application already exists, and can be easily modified for public facing deployment on an interactive kiosk.

Emerging Markets

In established economic environments, the opportunity for growth in the kiosk market is primarily in this area. There are also many countries that may have the technology, but have not seen a coordinating economic growth. As a result, those countries are also in the high growth potential portion of the chart, rather than the mature or declining area.

While kiosks in general might be considered a mature market in certain economies, (the UK & US for example), tablet kiosks are a high growth market in every economy. Enterprise tablet adoption in general is still in a high growth phase and predictions show that the number could reach a billion worldwide by 2017. Penetration rates in developing economies will lag significantly, so tablet kiosks are at the high growth phase in established economies and are likely in the introduction stage for less established economies.

Evolving Usage

The entry of Mobile Device Management into the picture also changes the landscape, with kiosk usage being broader and expanding into new market opportunities. One such example is the Purposed Device. A Purposed Device is a more mobile kiosk – something retailers, sales reps, or employees can carry around, but still use in a specific, secured manner both with regard to kiosk software and kiosk hardware (mobile, transportable enclosures with card reader attachment and stationary docking stations). Purposed Devices, like tablet kiosks, are still nascent with regard to market penetration.

Conclusion

Like cars and phones, kiosks look very different from what they were 25 or 35 years ago. With continued iterations to incorporate new technologies, kiosks can become even more efficient, cost effective, mobile and useful. They can continue to evolve in saturated areas and expand into high growth markets. Kiosks have never been as affordable, scalable and accessible as they are today and they are most certainly still growing in market penetration.

For more about LGN Media visit their website.