Table of Contents

Review 2025 Tillster Phygital Index Report

The “2025 Tillster Phygital Index Report” is a comprehensive analysis of consumer behaviors and preferences related to digital and physical ordering experiences in the quick-service restaurant (QSR) and fast-casual sectors in the United States. The report is confined to US-based consumers, based on a survey of 1,005 diners conducted in February 2024.

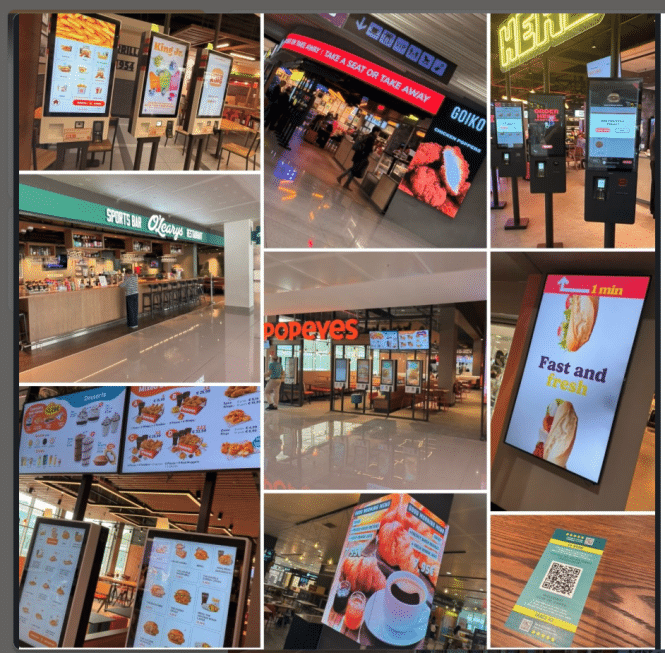

Cover image courtesy Acrelec

Outline and Summary:

Introduction

-

Digital ordering has become a deeply ingrained habit, reshaping customer engagement.

-

Consumers expect seamless interaction across multiple touchpoints—inside the store, curbside, delivery, or via apps and websites.

-

Key trends include increased interest in pickup options, demand for personalization, expectations for interoperable ordering, and a decline in reliance on third-party services.

Key Phygital Touchpoints

-

Self-Service Kiosks

-

45% of diners used kiosks in the past three months; 26% used them regularly.

-

57% of kiosk users want more kiosks.

-

Users enjoy exploring menus and customizing orders; many experience surprise at new menu options.

-

Expectations for kiosks to match cashier capabilities are high (83%).

-

Kiosks can increase average order size by 15-30%, reduce staffing pressures, and cater to both “beeliners” (efficiency-focused) and “explorers” (menu browsers).

-

-

In-Store, Curbside, and Delivery

-

Usage of restaurant-specific apps/websites for pickup/delivery is rising, with 42% for pickup and 36% for delivery.

-

61% of consumers have abandoned delivery orders due to high costs, highlighting an opportunity for restaurants to promote their own platforms.

-

Curbside pickup is increasingly popular, with 89% willing to visit a QSR offering this service, up from 69%.

-

Challenges include parking issues, affecting over half of pickup orders.

-

-

Proprietary vs. Third-Party Platforms; App vs. Website

-

65% prefer restaurant-specific apps/websites for pickup and delivery.

-

Use of third-party platforms is declining, with a shift toward owned channels to improve profitability and control.

-

Consumers expect a consistent experience across all digital channels; inconsistency frustrates 89% of customers.

-

Nearly equal usage of apps and websites (23-37%), emphasizing the need for cohesive digital experiences.

-

Improvements desired include better order tracking, exclusive offers, and easier reordering.

-

Key Data Points

-

Kiosk Usage: 45% used kiosks in the past three months; 41% use them 1-3 times per month.

-

Customer Preferences: 45% of kiosk users want more kiosks; 83% expect kiosks to match cashier capabilities.

-

Off-Premise Ordering: 42% used restaurant-specific websites/apps for pickup; 36% for delivery; 34% for third-party services.

-

Shift Away from Third-Party: Consumers are gradually reducing reliance on third-party apps, favoring direct channels for cost and loyalty benefits.

-

Pickup Trends: 89% of diners are more willing to visit QSRs with curbside pickup options.

-

Experience Consistency: 89% are bothered by inconsistent experiences across locations.

-

Loyalty Programs: 61% belong to at least one; 85% are satisfied; personalization and rewards are key drivers.

-

Personalization: 58% are likely to recommend a QSR based on personalized experiences; personalized messages are most received via mobile apps and email.

-

Technology Expectations: Consumers want features like order customization, personalized offers, and easy sign-up processes.

Conclusions

-

Digital and physical touchpoints must be integrated for a seamless experience.

-

Consumers increasingly favor direct, owned channels over third-party platforms, driven by cost and experience consistency.

-

Personalization and loyalty programs are critical for customer retention.

-

QSRs should focus on enhancing app and website functionalities, ensuring consistency, and leveraging loyalty data for personalized marketing.

Scope

-

The report is confined to the US market, based on a consumer survey within the country. It does not include international data.

This report offers valuable insights for QSRs aiming to optimize their digital and physical customer engagement strategies in a rapidly evolving phygital landscape.

Background

The word “phygital”—a blend of “physical” and “digital”—was first coined in 2007 by Chris Weil of the advertising agency Momentum Worldwide23456. The term originally emerged in the context of marketing communications to describe strategies and experiences that bridge the gap between the physical and digital worlds, creating seamless, integrated customer interactions2356.

Since its introduction, “phygital” has expanded beyond marketing to encompass a wide range of industries and applications, including retail, hospitality, technology, and customer experience design. Its core meaning remains the integration of physical and digital elements to enhance and unify user experiences across both realms246.