Carvana Vending Machine – What Went Wrong

Update 2/25/2025 Carvana Vending Machine Resurgence

Carvana has experienced significant success and growth over the past 12 months, achieving several notable milestones:

Financial Performance — Record Revenue: Carvana reported total revenue of $13.67 billion for the full year 2024, representing a 27% increase year-over-year14.

Profitability: The company achieved its first-ever annual profit, with a net income of $404 million and a 3.0% net income margin for the full year 202414.

Adjusted EBITDA: Carvana reached a record adjusted EBITDA of $1.38 billion with a 10.1% margin, setting an industry-leading benchmark among public automotive retailers14.

Sales Growth — Retail Unit Sales: The company sold 416,348 retail units in 2024, marking a 33% increase compared to the previous year14.

Market Share: Despite its strong growth, Carvana still only holds approximately 1% market share in the used car market, indicating significant potential for further expansion1.

Recent Performance In the fourth quarter of 2024, Carvana demonstrated continued momentum:

Sold 114,379 retail units, a 50% year-over-year increase

Generated revenue of $3.55 billion, up 46% year-over-year

Achieved a net income of $159 million with a 4.5% margin14

Future Outlook

Carvana expects significant growth in both retail units sold and Adjusted EBITDA for 2025, including sequential increases in the first quarter of 202514.

This strong performance over the past 12 months represents a remarkable turnaround for Carvana, positioning the company as a leader in the e-commerce platform for buying and selling used cars

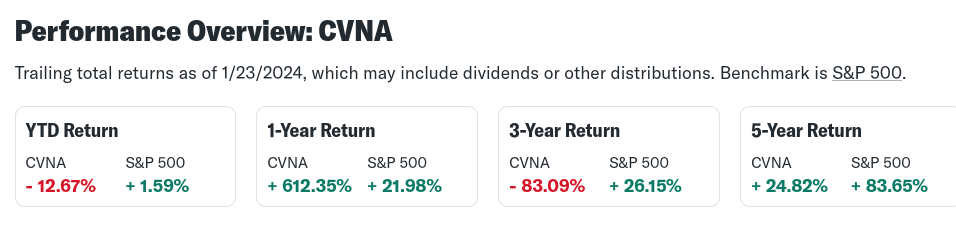

Update 1/23/2024 — One year performance has been pretty good up from 10 to 40 basically. Not anywhere near its former high of 300. In 2024 it has been sliding and it has been shorted. All in all it appears there are some dark clouds on the horizon.

Update 2/25/2023 – The slide continues (8 stock price). The operative phrase seems to be “red flags”. While still up this year there is little good news to support as poor earnings just came out and the debt level is too high and high cash burn rate. Link

It wasn’t that long ago the Carvana was all over your TV screen. Here in Denver a large 8-story car vending machine was built, and now sits empty. Local news stations satirize it with “what should we do with it” scenarios. Back in the day it was a revolutionary concept with promises of a big expansion, not a big collapse. Stock price has plummeted from a high of $337 in July of 2021 to a current price of $14.

Automated car vending seemed like a good idea (Intellivision, Laserdisc, etc) but then so many promising technologies silently reversed and retreated into the darkness so to speak.

Carvana isn’t quite dead yet but given inflationary pressures, interest rates they are going to likely have to more than the usual cost-cutting measures in order to remain viable.

Video

Excerpt

Just in January, the Wall Street Journal reports Carvana has laid off and let go of more workers and is letting other positions remain open, at the same time as having smaller sales and inventory that doesn’t sell as quickly as it used to. Barron’s reports Carvana admitted to breaking the law in Michigan which resulted in losing the operating license for its sole vending machine site in the state, and Seeking Alpha reports the battle between meme stock punters and the wider market got so volatile that the exchange briefly halted trading in the stock. We’re only two weeks into the new year. So the press launch date in Denver is likely well down the company’s list of priorities. Maybe things will go better with the Professional Pickleball Association, which counts Carvana as the title sponsor since October of last year.

Hotcars Did a Nice Writeup – the rise and fall of the Amazon of used cars

Summary of the negatives they note

- Endless legal problems (250 days to obtain a title e.g.)

- failure to provide permanent registration

- Only got temporary tags that expired

- Alleged wrongdoing

- insider trading

Excerpt

If Carvana had played its cards correctly, it might have been a market monster comparable to Amazon in the U.S. or Alibaba in China. That it didn’t is the problem. Everything was in Carvana’s favor, which only serves to highlight how terrible the result is. During the pandemic, even consumer segments that traditionally were not interested in online retail discovered digital technology. Used car dealers had to close their brick-and-mortar locations. And buyers received stimulus checks they could use as a down payment for a used car. Basically, the entire universe conspired in favor of Carvana, and for a while, it worked.

More posts

- Amazon Vending Machine Competitor Vicki(Opens in a new browser tab)

- Supreme Court Rejects Coca-Cola Case on Vending Machine ADA Compliance(Opens in a new browser tab)

- Free vending machines for homeless people are coming to the U.S. in 2018(Opens in a new browser tab)

Carvana Update Feb 12

- There are now cars in the Denver facility for some reason — link to Channel 9 story

- Carvana’s (CVNA) stock closed 6% higher on Wednesday after soaring as much as 27% during the session, triggering a volatility halt. Shares of the online car retailer, which is at risk of bankruptcy, have gained more than 200% year-to-date amid a recent rally reminiscent of the pandemic-era “meme craze.” Carvana’s stock is heavily shorted, with short interest hovering around 67% of the float. Short sellers have been betting that the unprofitable company’s share price will go down. But when it rises, they are forced to cover their positions by buying the stock back. This creates what’s called a short squeeze. — Link on Yahoo Money

-

Avoid the Short Squeeze Like The Plague – Motley Fool — Carvana (NYSE: CVNA) stock just experienced a dramatic turnabout. The stock price is up more than 200% since the beginning of the year as investors communicating through Reddit investing boards have again banded together to buy shares of a distressed company in the hopes of inducing a short squeeze.

With Carvana in severe financial straits, buying such a stock brings a significant risk of an eventual wipeout. Investors should understand how the higher stock price could help the company. Still, they should probably see the jump in shares as a cautionary tale rather than an opportunity for a quick return on this retail stock.