Last Updated on December 28, 2025 by Staff Writer

Market Data Research for McDonald’s and Other Restaurants

Report on restaurant market research and kiosks worldwide by Dataos (RBR). Much better than the usual internet scrapes for the Indian datamarts like Research & Markets. They actually contacted us and we provided input on McDonald’s and Burger King. Wendy’s too. Other research conpanies do not canvas people so kudos to Datos/RBR

It’s pretty clear though the bias is “Not the US” as the central theme. Certainly Acrelec has McDonalds but the franchise option is not always executed. We have never seen kiosks in Burger King or KFC here in the US. Pretty much all drive thru.

- As far as Acrelec goes it is important to note they are software as much as hardware. Not common knowledge but we know they have over 30K software licenses in play and they are close to announcing more.

McDonald’s is actually more ROW (40K restaurants) than US (14000 restaurants). And worth noting 700 of those in US are owned by McDonalds. The others are franchisees. Other McDonalds players which seems to be not noted would be the Verifone/Zivelo original along with Evoke in UK.

McDonalds splits its supply chain fairly evenly into multiple suppliers (DN, Verifone, Acrelec, Evoke and Coates to name notables). In the US Coates made the first investment followed later by Acrelec. Worth noting Verifone/Zivelo is rumored to be withdrawing from the market (mostly US). Verifone was pitching PO it wanted to dispose of.

We recently toured just completed new “counterless” McDonald’s (no menu boards above a short counter) here in Colorado. Also the drive thru menu boards are facing directly into the sun. We saw menu board failures in California and Coates screens. These are also Coates screens and we’ll see if they learned anything (or went cheap)

- And the “Diebold” kiosks are Pyramid of Germany white labeled. Nice of Datos to include that nugget from us in their report (with zero credit I might add).

Our take:

- Doesn’t appear Datos/RBR is going to offer any insight on US Market.

- Very very pricey report. Will be out of date in a week?

- How much longer will McDonald’s use the big standup totem kiosks with 32 inch monitors? Here is a new 2024 iteration of McDonalds in Denver with basically no counter, no menu boards and only a row of ordering kiosks

- How much longer before they go voice order? Here is a 2024 demo of McDonalds voice order being tested.

- When will McDonalds start utilizing the walls. They are already removing drinks and condiment stations

- Worth noting — 65% of sales at McDonalds is thru Drive Thru. Chick-Fil-A is the same (and drive-thrus getting bigger)

Meanwhile here is summary of article

- Market Growth and Competition:

- Over 345,000 self-ordering kiosks were installed globally by June 2023

- The market is competitive, with around 180 hardware and software vendors working with QSR chains

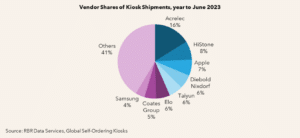

- Acrelec leads the hardware market, supplying McDonald’s, Burger King, and KFC

- Other players include HiStone, Taiyun, Coates Group, Elo, and Diebold Nixdorf.

- Global and Local Vendors:

- International players like Samsung and LG, along with local suppliers, compete for kiosk business

- China’s CCL Technology and Taiwan’s Posiflex have a growing presence in Europe and the Middle East

- Brazil’s Videosoft and Poland’s M4B also work with QSR chains

- Software and Digital Transformation:

- Many restaurants deploy self-ordering kiosks alongside mobile ordering as part of digital transformation

- McDonald’s uses an in-house solution, while other QSR brands partner with third-party software suppliers

- Demand for kiosks continues to grow, with RBR Data Services forecasting 130,000 kiosks shipped globally by 2028