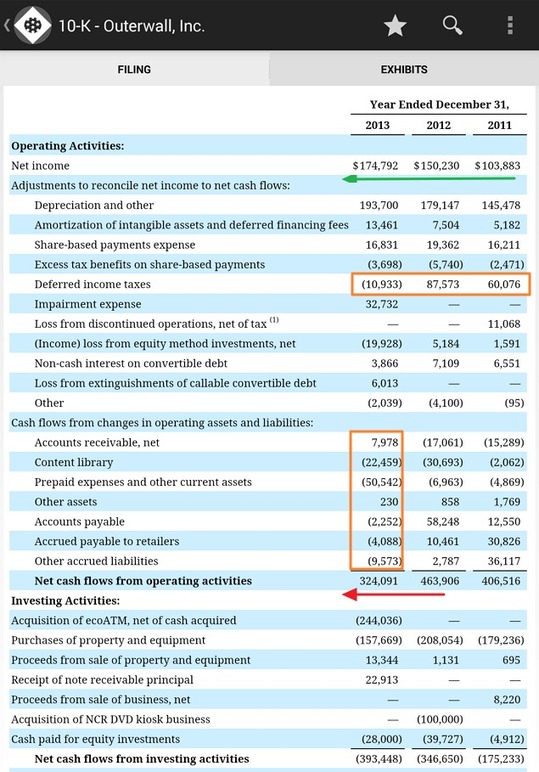

Outerwall (NASDAQ:OUTR) is selling for $1.17 billion and has free cash flow guidance of $200m to $240m. They are in the middle of a massive share repurchase program. Check out the piece of work they have done on their shares

Source: seekingalpha.com

in depth look at the business of Outerwall. It seems to walk the line between undervalued and overvalued depending on who you talk to. The cash flow certainly looks appealing (for now).