Diebold Venture With Inspur Provides ATMs & Kiosks To China

NORTH CANTON, Ohio, Dec. 18, 2015 /PRNewswire/ — Diebold Forms New Joint Venture With Inspur, One Of China’s Leading IT Companies, To Provide ATMs And…

Source: www.prnewswire.com

NORTH CANTON, Ohio, Dec. 18, 2015 /PRNewswire/ — Diebold, Incorporated (NYSE: DBD) today announced it is forming a new joint venture with a subsidiary of the Inspur Group, a Chinese cloud computing and data center company, to develop, manufacture and distribute financial self-service solutions in China. Inspur will hold a majority stake of 51 percent in the new joint venture, which will be named Inspur Financial Information Systems, Ltd. The joint venture will offer a complete range of self-service terminals within the Chinese market, including automated teller machines (ATMs). Also, Diebold will serve as the exclusive distributor outside of China for all products developed by the new joint venture, which will be sold under the Diebold brand.

In addition, to support Diebold’s services-led approach to the market, Inspur will acquire a minority share of Diebold’s current China joint venture. Moving forward, this business will be focused on providing a whole suite of services including installation, maintenance, professional and managed services related to ATMs and other automated transaction solutions.

Inspur Group is an $8 billion Chinese multinational information technology provider headquartered in Jinan, Shandong,China, with more than 70 years in business. The company specializes in IT hardware and software, and is a leading self-service kiosk manufacturer for major financial institutions in China. Inspur’s clients and business partners also include LG, IBM, Cisco, Microsoft, VMware and Micron.

“Partnering with Inspur enhances our competitive position and deepens the relationship with our customers in China,” saidAndy W. Mattes, Diebold president and chief executive officer. “Inspur’s strong reputation as a leading China IT company with a global footprint allows our new joint venture to bring more innovative solutions to China’s financial institutions and strengthens Diebold’s go-to-market strategy in this important market. We look forward to re-igniting growth in China and are excited to work with Inspur to sell a complete suite of self-service products and related services.”

“We are very happy to enter into this venture with Diebold, a well-respected global leader in financial self-service solutions, to continue growing our own presence in this market in China,” said SUN Pishu, president and CEO of Inspur Group. “Inspur is one of the fastest-growing self-service technology providers in China. Combining both company’s technology, sales expertise and existing presence in China will be of great value, both to our clients and our respective businesses.”

Upon closing the agreement, Diebold will appoint a chairman of the new joint venture, while Inspur will appoint a chief executive officer for the business to lead day-to-day operations. The agreement is anticipated to be finalized in mid-2016, pending regulatory and other approvals, with plans to begin manufacturing and distribution activity immediately after regulatory approvals.

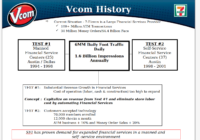

MoneyGram International (NASDAQ: MGI), a leading global money transfer and payment services company, has extended its agreement with 7-Eleven in Austr

MoneyGram International (NASDAQ: MGI), a leading global money transfer and payment services company, has extended its agreement with 7-Eleven in Austr